Jim Bessen and Mike Meurer have published their latest paper examining the impact of "patent trolls" (they politely refer to them as Non-Practicing Entities or NPEs) on our national economy. Entitled The Direct Costs From NPE Disputes [PDF], the paper examines the direct costs of patent assertions by NPEs against operating companies, i.e., companies that actually make things to earn their revenues. More on the Bessen/Meurer paper in a bit.

In the meantime, Prof. Colleen Chien of the Santa Clara University School of Law is conducting a survey on the economic impacts of patent litigation, and she could use your help. Prof. Chien is particularly interested in survey responses from start-ups and small companies. Respondents need not be patent holders or in the technology business. If you know of anyone who could provide a useful response, please encourage them to participate.

Now, back to the Bessen/Meurer paper. Here are some of the highlights:

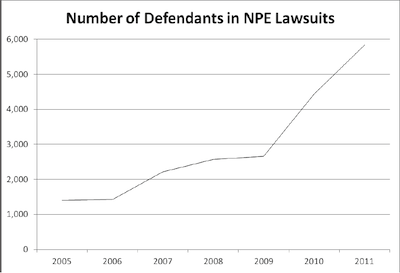

- The number of defendants in NPE patent suits doubled from 2009 (approximately 2,700) to 2011 (more than 5,800).

- Direct costs of patent assertions by NPEs are costing our national economy more than $29 billion dollars a year, and that tab also doubled from 2009 to 2011.

- Much of the burden of this NPE litigation falls on small and medium-sized companies. 82% of the defendants, accounting for 50% of the defenses, had median revenues of less than $12 million a year.

- They find little evidence to support the contention that NPEs promote invention. [Why am I not surprised?!]

For those who are not familiar with the authors, Michael Meurer is a professor of law at Boston University. He holds both a J.D. and a Ph.D. in economics. James Bessen is a Lecturer in Law at Boston University School of Law and a Fellow at the Berkman Center on Internet and Society at Harvard. Together these gentlemen have written more than a half dozen papers on the patent and its impact on technology and the economy. Among their previous papers are:

- The Private and Social Costs of Patent Trolls (2011)

[PDF];

- The Private Costs of Patent Litigation (2008)

[PDF];

- Lessons for Patent Policy from Empirical Research on Patent Litigation (2005) [PDF]; and

- The Patent Litigation Explosion (2005)

[PDF].

What is interesting about that earliest paper is that it anticipated the very explosion in patent litigation that has occurred in the last three years. In any case, this latest paper is worth a read. It is reproduced below in text form.

*******************************

BU School of Law

THE DIRECT COSTS FROM NPE DISPUTES

Boston University School of Law Working Paper No. 12-34

(June 25, 2012)

Revised June 28, 2012

James Bessen

Boston University School of Law

Michael J. Meurer

Boston University School of Law

This paper can be downloaded without charge at:

http://www.bu.edu/

law.faculty/scholarship/workingpapers/

2012.html

The Direct Costs from NPE Disputes

By James Bessen and Michael J. Meurer (Boston University School of Law

6/22/12

Abstract:

In the past, “non-practicing entities” (NPEs), popularly known as “patent trolls,” have

helped small inventors profit from their inventions. Is this true today or, given the

unprecedented levels of NPE litigation, do NPEs reduce innovation incentives? Using a

survey of defendants and a database of litigation, this paper estimates the direct costs to

defendants arising from NPE patent assertions. We estimate that firms accrued $29 billion

of direct costs in 2011. Moreover, although large firms accrued over half of direct costs,

most of the defendants were small or medium-sized firms, indicating that NPEs are not just

a problem for large firms.

We thank David Anderson and the staff at RPX for invaluable assistance. We thank Brian

Love, Michael Risch, and Catherine Tucker for helpful comments, and Cong Yao, supported

by funds from the Coalition for Patent Fairness, for able research assistance.

Executive Summary

This paper analyzes the direct costs of patent assertions by “non-practicing entities”

(NPEs) against operating companies using a survey of defendants and a comprehensive

database of NPE lawsuits. The main findings include:

- NPE litigation is growing rapidly, affecting 5,842 defendants in 2011.

- The direct costs of NPE patent assertions are substantial, totaling about $29 billion

accrued cost in 2011, including the costs of non-litigated assertions. This figure

excludes various indirect costs to the defendants’ businesses such as diversion of

resources, delays in new products, and loss of market share.

- Much of this burden falls on small and medium-sized companies. The median

company sued had $10.8 million in annual revenues. 82% of the defendants had less

than $100 million in revenue and these accounted for 50% of the defenses. Small

and medium-sized companies account for 37% of the accrued direct costs.

Moreover, compared to revenues, the direct costs of NPE patent assertions are

relatively larger for small companies.

- We find little evidence that NPEs promote invention overall. Publicly-traded NPEs

cost small and medium-sized firms more money than these NPEs could possibly

transfer to inventors. This reduces the net amount that firms of any size have

available to invest in innovation.

- NPEs appear to be highly heterogeneous. Much of the litigation appears to consist

of nuisance suits that settle for a few hundred thousand dollars. But some NPEs are

“big game hunters” who seek and get settlements in the tens or hundreds of million

dollars.

2

Introduction

What sort of costs do Non-Practicing Entities (NPEs) impose on firms targeted for

the assertion of their patents? What do target firms spend on legal services and how much

do they pay for licenses? And what sort of firms do NPEs target? We present answers to

these questions based on a unique survey of defendant companies and a comprehensive

database of NPE litigation. The survey, which covers 82 firms who mounted 1,184 defenses

against NPE litigation, is unique in three ways. First, it includes defendant companies that

are privately held, including small firms. Second, it reveals information about costs

associated with cases in which NPE patents are asserted but which are resolved before a

lawsuit is filed. Finally, it provides aggregated information about NPE patent license fees.

These kinds of information have not been available, in part, because the terms of patent

licenses are often secret, and in part because previous surveys have simply not asked about

assertions that did not advance to the filing of lawsuits. The costs disclosed by this survey

are significant and should play a prominent role in policy debates about the treatment of

NPE patent lawsuits.

NPEs are individuals and firms who own patents but do not directly use their

patented technology to produce goods or services, instead they assert them against

companies that do produce goods and services. In the past, some NPEs have played a

valuable role in bringing innovations from small inventors to market. Some inventors lack

the resources and expertise needed to successfully license their technologies or, if necessary,

to enforce their patents. NPEs provide a way for these inventors to earn rents that they

might not otherwise realize, thus providing them with greater incentives to innovate. But in

3

the past, also, some NPEs have used patents opportunistically. During the late nineteenth

century, “patent sharks” were widely seen as extracting money from innocent individual

farmers and railroad companies (Magliocca 2007).

However, while NPEs have been around for a long time, over the last few years,

NPE litigation has reached a wholly unprecedented scale and scope (Patent Freedom, 2012;

RPX, 2012). In 2011, 2,150 unique companies were forced to mount 5,842 defenses in

lawsuits initiated by the actions of NPEs.1 Moreover, the number of defenses has been

growing rapidly (see Figure 1). Part of this growth has been fueled by new sources of

funding and new business models.

The costs born by defendants in these assertions are key to evaluating the private and

social impact of this new phenomenon. In previous research with co-author Jennifer Ford

(Bessen et al. 2011), we have estimated the total costs of NPE litigation for publicly listed

firms using stock market event studies. This study complements our earlier study by

obtaining estimates of the direct cost portion of total costs using data from a survey of

defendants.2 Direct costs include the cost of outside legal services, licenses fees, and other

direct costs incurred in response to NPE litigation risk.3

This study also complements our earlier study by providing information on

companies that are not publicly listed, including small companies. This information helps

4

reveal the extent to which NPEs help small firms realize profits from their innovations and

the extent to which small firms, to the contrary, incur costs as the targets of NPEs.

Literature Review

Large scale NPE patent litigation is a recent development, thus the empirical

literature is thin. Our NPE lawsuit event study is the most closely related piece of earlier

research; in it we found that the annual wealth lost from NPE lawsuits was about $80 billion

for publicly traded U.S. firms (Bessen et al. 2011). In theory, this cost could be composed

mostly of transfers in the form of royalty payments to NPEs. Indeed, a number of papers

argue that NPEs play a socially valuable role by enabling small inventors to realize greater

profits from their inventions (Hosie 2008, McDonough 2006, Shrestha 2010, Myhrvold

2010, Morgan 2008). These papers, however, do not provide empirical evidence to support

that assertion.

Our 2011 paper rejected that possibility based on the evidence available to us; we

concluded that much of the cost borne by technology companies as they defend against

NPE lawsuits is a social loss and not a mere transfer. The survey results we describe below

provide strong additional support for our view that much of cost imposed on defendants is a

social loss. In particular, the current study finds that NPEs impose costs not only on large

technology companies, but also on very many small and medium firms, making it even less

likely that innovative start-ups are net beneficiaries of NPE activity.

One other researcher has quantified the costs to defendants from NPE litigation.

Catherine Tucker examines the effect of a lawsuit by an NPE (Acacia) against several firms

that make medical imaging software. She compares the impact of the lawsuit on sales of

both medical imaging and text-based medical software produced by the targeted firms. She

5

also compares the sales by the targeted firms to the sales of medical imaging software made

by other firms in the industry who were not targeted with a lawsuit. She finds that sales of

medical imaging software declined by one-third for targeted firms. She attributes the sales

decline to a “lack of incremental product innovation during the period of litigation,” and she

conjectures that incremental innovation was deterred by concerns it would create additional

risks in the on-going litigation. (Tucker 2011).

Two other strands of previous research are especially relevant to this project. First,

earlier work has quantified legal fees associated with patent litigation. We collected data

about legal fees that were made public in court decisions concerning fee-shifting in patent

cases (Bessen and Meurer 2012). Also, the American Intellectual Property Law Association

conducts a biannual survey of its members and includes questions about fees in patent

lawsuits (AIPLA 2011). The sources are helpful and we report some of their findings below,

but they do not contain information about NPE litigation in particular, and they do not

contain information about assertions that never reach the filing of a lawsuit.

A better-developed strand of literature reports various characteristics of NPE

litigation.4 While not measuring costs, these studies do shed light on the question of whether

the private losses to firms targeted by NPE patent assertions also tend to be social losses.

The answer appears to be yes. NPE patent litigation has all the hallmarks of patent notice

failure that distorts the patent system and makes it impede technological progress. In Patent

Failure (Bessen and Meurer 2008) we show that the U.S. patent system works well for

chemical and pharmaceutical inventions because the system provides clear notice to the

world of the scope and existence of patent-based property rights. For most other inventions,

6

especially software and business methods, notice failure means that innovative firms are

targeted in patent infringement suits through no fault of their own.

Notice failure is likely for NPE lawsuits. Sixty-two percent of the time they feature

software patents (Bessen et al. 2011) which are notoriously difficult to interpret. Allison et al.

(2010) study patents litigated multiple times and usually asserted by NPEs; they find that

software patents account for 94% of such lawsuits. The patents asserted in NPE lawsuits are

often subject to lengthy prosecutions which delays public access to information about patent

claims (Allison et al., 2009, Love 2010, Risch 2012). Rather than transferring technology and

aiding R&D it appears that NPEs usually arrive on the scene after the targeted innovator has

already commercialized some new technology (FTC 2011).

Data

Survey

Between February and April 2012, RPX invited about 250 companies to participate

in a survey of their NPE-related costs. The pool of invitees included RPX clients and nonclient

companies with whom RPX has relationships. Most invitees were technology

companies, but certain non-technology companies with NPE exposure were also invited (for

example retailers with e-commerce exposure). Participants provided information to the

extent that doing so was consistent with their obligations to third parties. The information

was aggregated and anonymized such that individual data was not disclosed.5

Participants filled out a standardized Excel template that included a range of

questions about their NPE-related costs. The instructions for the template asked that

participants include certain statistics estimating all of their direct (external spend) NPE-

7

related costs from 2005-2011. An NPE was defined to include patent assertion entities,

individual inventors, universities, and non-competing entities (operating companies asserting

patents well outside the area in which they make products and compete). This is the same

definition of NPE used on the NPE Lawsuit Database (see below). A list of each

participant’s NPE litigations from that database was provided to ensure alignment between

the survey response and database. Templates were submitted by email or directly into a

secure online data room. To the extent possible, an RPX study team reviewed the

submission for quality and completeness. If needed, the company was asked certain followup

questions. Finally, RPX aggregated the submitted data within a secure computing

environment. The resulting dataset forms the basis of the data tables provided in this

document.

Of the 250 companies invited to participate, 82 provided data on lawsuits and of

these, 46 also provided data on non-litigation patent assertions and related costs.

NPE Lawsuit Database

In addition to the survey, we also used a comprehensive database of NPE litigation

developed by RPX. These NPE litigation statistics are based on cases coded “830 Patent” in

the PACER database which is maintained by the Administrative Office of the U.S. Courts.6

In case counts, RPX excludes misfiles, non-patent, false marking and other non-core patent

infringement cases. When a case is transferred, RPX counts it as one case and allocates it to

the venue to which it was transferred. When several cases are consolidated into one, RPX

counts it as one case but with multiple defendants. When a case is severed RPX counts it as

separate cases. In defendant counts, RPX rolls up operating company subsidiaries into a

8

parent entity (Samsung Group and Samsung Electronics count as one defendant).

Declaratory actions are included in case counts unless otherwise noted.

RPX defines NPEs as discussed above and identifies NPEs through a manual review

process. In this review process, RPX reads patent complaints found in PACER and checks

information in the complaint against its NPE database. RPX also checks its database of

plaintiff counsel, searches public filings and performs web research. Some of the factors

they consider when determining whether a company is an NPE (or more specifically a patent

assertion entity “PAE”) include: Is the entity the same as or share a substantial financial link

with a known PAE? Is there any evidence that the company sells a product or offers a

service? Does the entity webpage prominently mention technology, licensing, and patents;

and not offer a product or sales? Does the complaint indicate whether the entity has a

product in-market or in-development that is being harmed by infringement? Are the lawyers

involved known to specialize in representing NPEs? Is this entity known as an NPE or as an

established operating company?7

Sample characteristics

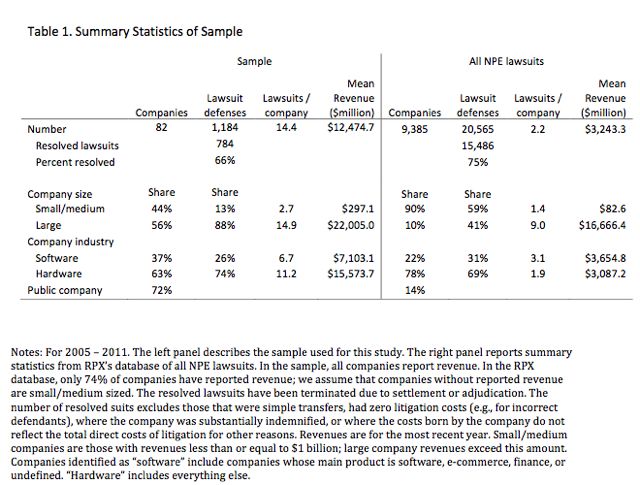

Table 1 compares characteristics of the survey sample with RPX’s database of NPE

lawsuit defenses. Data for the survey are on the left while data for the entire database of

NPE defenses are on the right. The 82 surveyed companies collectively mounted 1,184

defenses in NPE lawsuits beginning between 2005 and 2011. Of these, 784, or 66%, were

resolved by adjudication or settlement and did not involve indemnification or other factors

that cause costs to be atypical.

9

Note that a possible truncation bias arises because so many lawsuits were unresolved

at the time of the survey. Because lengthier disputes tend to be more costly, at least as far as

legal costs are concerned (Kesan and Ball 2005), and because the number of lawsuit filings

has risen sharply in recent years, cost estimates based only on resolved lawsuits might be

understated.

We divided the companies into sub-categories based on their revenue in the most

recent year reported. We categorize companies as small, medium or large depending on

whether reported revenue for the most recent year is less than $100 million, between $100

million and $1 billion, or above $1 billion. The $100 million revenue cutoff for small

companies corresponds roughly to 500 employees, which is the cutoff used by the US Patent

and Trademark Office and other government bodies to categorize small companies. While

we have revenue data on all of the companies in the survey sample, the RPX database

reports company revenue for only 74% of the defenses. These data come from public

reports and from Dun and Bradstreet, which estimates revenues for private companies. It is

thus likely that almost all of the companies without reported revenue are small companies. In

much of the analysis below, we explicitly assume this to be the case. This assumption is

conservative in that it results in a lower estimate of aggregate costs of litigation.

We also divided companies into two broad industry sectors depending on whether

they were in the broad software industry, including e-commerce and finance, or instead in a

hardware industry (everything else).8 The latter distinction might be significant because most

10

hardware industries involve greater sunk capital costs than do software industries or finance

and for this reason hardware industries may be more at risk of hold up.9

The right panel shows that small and medium firms dominate the universe of NPE

defendants. Small and medium-sized companies make up 90% of the defendant firms,

mounting 59% of the defenses. Firms making less than $100 million in revenue account for

82% of the defendants and 50% of the defenses, assuming that firms with unreported

revenue are small.10 The median revenue of a defendant company reporting revenue is $10.8

million.

As the Table shows, our survey sample consists of companies that are larger, more

likely to be public and which experience relatively more lawsuits than the average NPE

defendant firm. In the rows that control for size and industry sector, survey firms appear to

experience about twice as many lawsuits as companies in the comprehensive database. This

is not surprising, however, it raises the possibility that our sample might be unrepresentative

of the broader population, possibly experiencing costs that are greater or smaller than those

of the universe of sued companies. Below we do a check on legal costs to test whether the

survey appears to have unrepresentative costs.

11

Findings

Mean and median costs

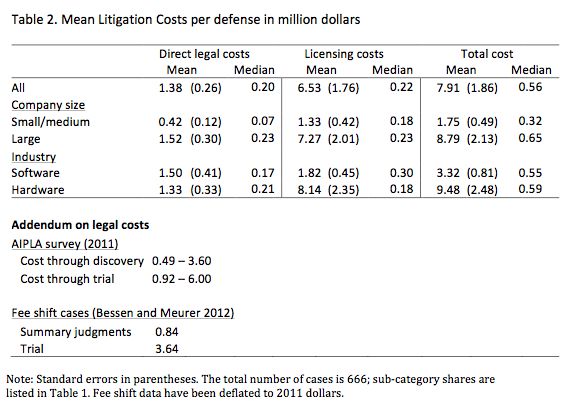

Table 2 provides estimates of mean legal11 costs, licensing costs and total costs (the

sum of these) with standard errors in parentheses. The table also shows median costs.

Median total costs per litigation defense fall roughly around half a million dollars,

smaller for small and medium firms, larger for big ones. However, mean total costs are much

higher, nearly eight million dollars for our survey sample. This difference implies that the

distribution of costs is highly skewed, as we explore below. Thus one must be particularly

careful in extending judgments about the costs of litigation based on small samples. While

“typical” costs might only be a few hundred thousand dollars, mean costs—reflecting the

large costs in a small number of very costly lawsuits—are an order of magnitude higher.

Mean total costs are, not surprisingly, significantly greater for large companies than

small and medium companies. This difference is significant at the 1% level.

The first column reports the legal component of costs. Mean legal costs per defense

range from $420,000 for small/medium companies to $1.52 million for large companies.

Column 2 of Table 2 reports the dollar amounts paid to the plaintiff to settle the

case.12 Column 3 reports the total costs, the sum of legal and settlement costs. The mean

settlement costs for small/medium companies are $1.33 million and for large companies,

12

$7.27 million. Mean total litigation costs are $1.75 million for small/medium companies and

$8.79 million for large companies.

Legal costs are about a third as large as settlement costs, or about one quarter of

total litigation costs (slightly larger for small/medium companies).13 This implies that a

substantial part of direct costs of NPE litigation is a deadweight loss to society.14 For the

median case, legal costs are roughly equal to settlement costs.

Also note that NPE litigation is relatively more costly to smaller companies. In our

sample, the large company litigation costs were five times as high as small/medium company

litigation costs. But (see Table 1) the mean revenue of large companies in our sample is

nearly seven times the mean revenue of the small and medium companies. This means that,

roughly speaking, smaller companies pay more in direct NPE litigation costs relative to their

size.

Hardware firms have higher costs than software firms. This difference is significant

at the 5% level. Since hardware firms generally have greater sunk costs than software firms,

this difference is consistent with the interpretation that hardware firms are more easily

subject to holdup and hence they have to pay more to settle litigation.

Comparison to other studies

As noted above, the survey sample was not randomly selected and hence it could be

unrepresentative. In particular, it might be that survey respondents tended to be firms with

higher than average litigation costs.

13

We can check the representativeness of our sample by comparing our findings to

other empirical evidence. In particular, legal costs can be compared to estimates derived

from two other sources. First, AIPLA conducts a bi-annual survey of its members who

estimate typical legal costs through discovery and through trial. They report these estimates

for three categories of patent lawsuits depending on the amount at issue in the controversy,

specifically, whether the amount at issue is less than $1 million, between $1 million and $25

million, and greater than $25 million. The first and third categories provide the ranges shown

in the addendum to Table 2.15 Few patent lawsuits go to trial (Kesan and Ball 2005), so the

figure for costs through discovery is probably closer to the mean cost for patent litigation.

On this basis, the AIPLA cost estimates are comparable or even higher than the mean cost

estimates from our survey.

We also compared the survey means to means from 137 cases where one party in a

lawsuit had been required to pay the others’ legal fees. These were for cases between 1985

and 2004 (Bessen and Meurer 2012). Converted into 2011 dollars, the cost for lawsuits that

ended in summary judgments was $840,000; the cost for those that ended in a trial verdict

was $3.64 million. Since most lawsuits are not settled by an initial summary judgment but are

settled before trial, mean legal costs should fall between these figures. Again, the survey

estimates seem broadly comparable. This suggests that our survey sample is not

unrepresentative.

It is possible, of course, that our survey might report representative legal costs but

unrepresentative licensing costs. This might happen, for instance, if our survey overrepresented

hardware companies who tend to have relatively higher licensing costs.

However, Table 1 suggests that the share of hardware firms in the survey roughly matches

14

the share in the universe of NPE defendants found in the database. Generally speaking,

firms with higher licensing costs will tend to have higher legal costs, all else equal. This is

because firms facing a large payout can typically reduce the payout or the likelihood of

having to pay damages in trial by mounting a more aggressive (and more expensive) legal

defense. That said, we cannot be certain that our estimates are representative, nevertheless,

the representativeness of our legal cost estimates provides some comfort that licensing cost

estimates are not too far off.

The distribution of litigation costs

Sample means do not capture the distribution of costs. In fact, litigation costs are

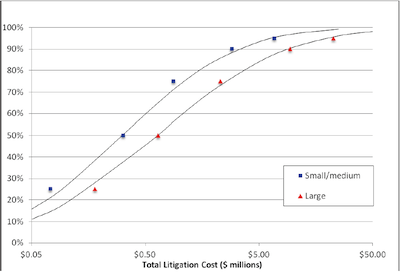

highly heterogeneous. Figure 2 shows cumulative distribution plots of total litigation costs

for the small/medium and large companies in our sample. The smooth curves represent

lognormal distribution functions fitted to the data.

As can be seen, the distribution is highly skewed. The median total litigation cost for

small/medium companies is $318,000 and for large companies it is $646,000. A large

fraction of lawsuits cost less than $200,000. But a small number of lawsuits cost much, much

more. For large companies, 5% of the lawsuits cost more than $22 million.

This heterogeneity likely arises in part from variation in NPE tactics. Schwartz (2012)

reports that some NPEs pursue nuisance suits in which they sue many companies, big and

small. Plaintiffs using this tactic are willing to settle for small payments, often no more than

the amount a defendant would spend on legal fees to defend the case. As one such plaintiff

lawyer put it, “An NPE intuitively understands that we could go for triples or home runs,

but we can also go for singles and get a good return and work on other things (Schwartz

2012).” Alternatively, NPEs may act like big game hunters, targeting only one or a few firms,

but hoping to win tens of millions of dollars. The lawsuit by NTP against BlackBerry maker

15

RIM is a good example. NTP asserted patents of doubtful validity but managed to win at

trial and obtain a settlement of $612.5 million from RIM (Bessen and Meurer, 2006). The

survey data does not permit us to clearly identify NPE tactics, but it does suggest that NPE

activity is not uniform.

While there are far fewer suits initiated by “big game hunters,” they represent a

disproportionate share of the cost. The distribution of costs is such that the top 5% of

defenses for large companies account for about two thirds of the total cost of defense for

large companies.

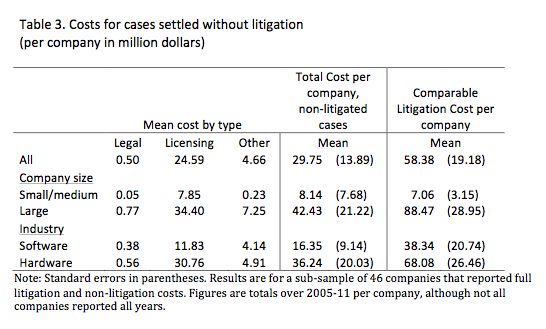

Costs from cases settled without litigation

Many NPE patent assertions are settled without a lawsuit being filed. To gather

information on non-litigated assertions, the survey also asked a series of questions regarding

these. Rather than count assertions, the survey asked respondents to report cumulative costs.

Most reported costs for the period from 2005 – 2011, but some did not have data for the

entire period. Moreover, only 46 of the companies completed this section of the survey.

The costs of assertions settled without litigation consist mainly of legal fees and

settlement costs paid to patent holders. They also include smaller amounts spent on NPE-specific

patent buying programs (including RPX services), on NPE-specific clearance

searches and on re-examinations of NPE patents.

The means of these components are reported in Table 3 along with the cumulative

litigation costs incurred by these same companies. For the sample as a whole, NPE costs

from cases without litigation were about half of the comparable costs of litigated cases. For

small/medium companies, in particular, however, costs of non-litigated cases exceeded

litigation costs. This might be because smaller firms lack internal legal resources, making it

relatively more expensive for them to pursue litigation. Also, costs of non-litigated cases

16

were higher relative to litigation costs for hardware firms, perhaps again because hardware

firms, being more at risk of hold up, find it less costly to settle sooner. This difference is not,

however, statistically significant.

In any case, it is clear that non-litigated patent assertions are responsible for much of

the direct costs imposed by NPEs on operating companies. In this regard, it is likely that our

sample under-represents these cost because we have only surveyed companies that have

been involved in litigation. That is, we have not included potentially large numbers of small

companies that have only settled NPE patent assertions and have not gone to court.

Anecdotal evidence from small companies suggests that there might be very many such

firms and their costs are missing from our analysis. Aggregate Costs of NPE Assertions

Aggregation

What is the aggregate cost of NPE patent assertions, including both litigated and

non-litigated assertions? To estimate this, we began by estimating the mean cost of resolved

litigation for small/medium firms and for large firms. We could have directly used the data

in Table 2, however, this might overstate costs because the average small/medium firm in

our survey sample is larger than the average small/medium firm in the entire database (see

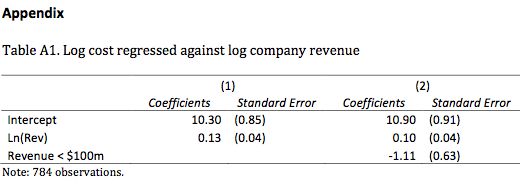

Table 1).16 To correct for this within-category variation, we regressed log cost against log

revenue for the survey sample and, using this, computed the predicted mean cost over the

actual distribution in the database for each size category.17 In using these means, we assume

17

that the lawsuits in each category in the database will on average accrue costs equal to these

respective mean values. That is, for lawsuits where the defendant was indemnified by a third

party, we assume that some party will pay an amount equal to the mean cost for defendants

in that category, even if the defendant firm itself does not necessarily pay this amount. Also,

we assume that lawsuits that are still underway will eventually accrue costs equal to these

means, even if the current out-of-pocket costs are not yet equal to this accrued cost.

To adjust these figures to account for assertions that are settled without litigation, for

each category we divided the total cost of non-litigated cases by the total number of lawsuits

filed, including lawsuits that were still active. This gave us a pro-rated cost of non-litigated

cases per lawsuit filed. We added this to the mean litigation cost for each category to give a

total cost of NPE assertions per lawsuit filed.18

The second part of this exercise consisted of breaking the cases in the RPX NPE

database into the two size categories. Where revenue was reported (about 74% of the

database), we allotted the defenses to small and large cells depending on whether the revenue

was smaller than or larger than $1 billion.19 We conservatively assigned those companies

without reported revenue to the “small” cells.

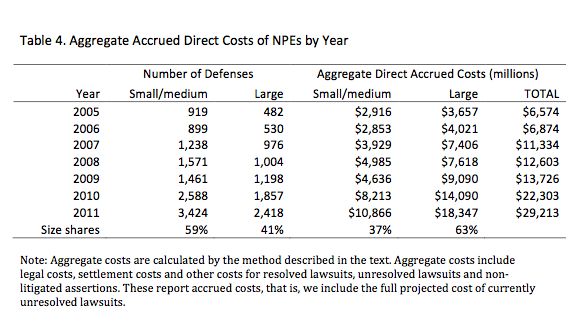

Year-by-year accrued costs

The left portion of Table 4 reports the number of defenses reported in the NPE

database by year for each size category. The right portion shows the aggregate cost of NPE

assertions per year calculated by multiplying the number of defenses reported on the left by

the prorated total cost of defense per cell (where the cost of defense includes license cost).

18

The final column reports the aggregate cost, summing over both categories for each year.

Aggregate direct costs of NPE patent assertions grew rapidly from about $7 billion in 2005

to $29 billion in 2011.20

It is important to note that these totals represent accrued costs, not necessarily the

immediate out-of-pocket cost. That is, we accrue the projected cost of a lawsuit in the year

in which the suit was filed, even though the lawsuit might not be resolved. This is important

because about half of the lawsuits filed in 2011 were not resolved at the time of our survey.

The implication is that substantial sums will be flowing to NPEs over the next several years

from lawsuits already filed. Because the number of NPE lawsuits has been growing so

rapidly, the current revenues of NPEs likely understate the total costs of lawsuits already

filed.21

Moreover, the effect of these assertions does not just fall on a small number of large

companies. Some NPE advocates have argued that NPE litigation is largely a matter of

lawsuits against a small number of large “serial infringers.” These data show, to the contrary,

that about 59% of the litigation events are directed to small and medium-sized companies

and about 37% of the aggregate cost falls on small and medium-sized companies. Moreover,

this share is likely understated because, as discussed above, this analysis does not include

those companies that have only had NPE assertions that did not go to court.

Finally, these tabulations do not include the indirect effects of NPE assertions on the

business of defendants. Case study evidence suggests that there are significant indirect costs

of NPE patent assertions (Tucker 2011). These include diversion of management or

19

engineering resources, delays in new product introductions and improvements, loss or delay

of revenue, and credit constraints. Bessen et al. (2011) estimate the total business costs of

NPE litigation for public firms using stock market event studies. Although the samples and

methods are not directly comparable, they find an aggregate loss of stock market

capitalization of around $80 billion per year during recent years, corresponding to an

aggregate cost in operational funds to the firms of about half that amount. This suggests

loosely that total business costs of NPE assertions might be at least twice as large as the

figures reported in Table 4.

Benefits to innovators

It is sometimes argued that NPEs facilitate innovation by providing incentives to

small inventors who would not otherwise be able to license their patents. In this view,

“NPEs create patent markets, and that those markets enhance investment in start-up

companies by providing additional liquidity options. NPEs help businesses crushed by larger

competitors who infringe valid patents with impunity. (Risch 2012)”

Michael Risch (2012) looks at the original assignees of patents used in NPE lawsuits

and finds that the David vs. Goliath narrative is not representative. Few of the patents in his

sample came from venture capital financed startup firms. Although 29% of the patents in his

sample were originally filed by individual inventors, 43% were from large companies. The

median revenue of a company filing an NPE patent in his sample is $6.3 million. Given that

the median revenue of a company in the RPX database of firms sued by NPEs is $10.8

million, it appears that the typical firm sued by an NPE is roughly the same size as the

typical firm benefiting from NPE activity.

How much of the costs accrued by defendants actually flow to inventors? We can

gain some indication of this by looking at the expenditures of publicly listed NPE firms.

20

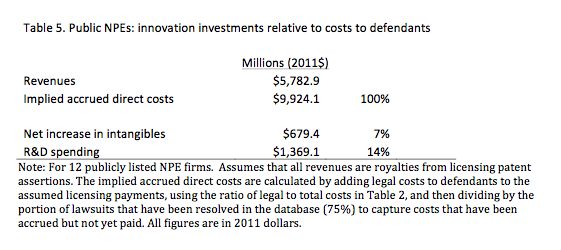

Table 5 reports cumulative figures in 2011 dollars for 12 NPE firms that were active

from 2005 – 2011.22 During this period, these firms cumulatively earned $5.8 billion in

revenues. If we assume that these revenues consisted entirely of licensing royalties from

resolved patent assertions and we assume that defendants in these cases also incurred legal

costs in the same ratio as those reported in Table 2, then these NPEs were responsible for

$10 billion in direct accrued costs to defendants from 2005 – 2011, about 10% of the totals

reported in Table 4.23

Looking at the financial statements of these NPE companies, we find that the

cumulative net increase in intangible assets—acquisitions of patents from small inventors

would be included in this accounting category along with acquisitions of other intangible

assets—amount to $679 million, or about 7% of the direct costs to defendants. Two of the

publicly listed NPE firms also perform their own R&D. That amounts to about 14% of the

direct costs to defendants. These two categories might overlap somewhat if R&D generates

intangible assets. Nevertheless, these figures indicate that for publicly listed NPE firms, no

more than a quarter of the direct spending by defendants flows to innovative activity.

Based on these figures, it seems difficult to make a convincing argument that the

effect of NPEs is to increase innovation incentives. First, previous research has shown that

the defendants in these lawsuits are largely tech companies that invest heavily in R&D

(Bessen et al. 2011, Chien 2009). This estimate suggests that their losses are much larger than

the possible flows to small inventors, especially if one adds indirect costs of NPE litigation

to the direct costs reported in Table 5. Effectively, what defendants pay in costs as a result of

21

NPE litigation reduces their own R&D budgets. This is because companies become targets

for litigation mainly when they introduce innovative products.24 Hence R&D managers must

anticipate NPE costs as part of the cost of innovating. Small inventors would have to be an

order of magnitude more innovative per dollar of R&D than the defendant companies, in

order for the net effect of NPE activity on innovation to be positive.

Second, to the extent that small inventors are important for innovation, NPE patent

assertions hurt small inventors in at least two ways. As we have seen, the majority of

defendants in NPE lawsuits are small/medium companies and these companies accrue larger

costs relative to their size. Small/medium firms accrue 37% of the costs, but small inventors

receive at most 21% of NPE costs. Also, these costs make things more difficult for small

inventors who wish to license their technology—not just their patents—to other firms. If

the prospective licensees expect NPE-related costs, they will be less willing to license from

small inventors or they will not be willing to pay as much.

Third, the incentives provided to patent holders by the current crop of NPEs may be

the wrong kind of incentives. NPE activity may skew the research agenda of small firms

away from disruptive technologies and toward mainstream technology and associated

patents that can be asserted against big incumbents. Even worse, small firms are encouraged

to divert investment from genuine invention toward simply obtaining broad and vague

patents that might one day lead to a credible, if weak, lawsuit.

Policy implications

The rapid growth and high cost of NPE litigation documented here should set off an

alarm warning policy makers that the patent system still needs significant reform to make it a

truly effective system for promoting innovation. The heterogeneous nature of NPEs –

22

ranging from universities, to patent brokers, to trolls25 – suggests that policy reform should

address troll-like behavior rather than merely status as an NPE (Geradin et al., 2008; Merges,

2011).

The top priority is reform of the patent system to improve notice; this kind of

reform will make the patent system perform more like an idealized property system (Bessen

and Meurer, 2008; FTC, 2011). More rigorous enforcement of the claim definiteness

standard would be an excellent step forward. Likewise, we favor rigorous implementation of

recent Supreme Court decisions restricting the patentability of business methods and other

abstract processes that are difficult to propertize. It is also crucial to provide greater

transparency in the patent system. Feldman and Ewing (2012) document the remarkable

opaqueness of Intellectual Ventures in connection to its patent ownership and patent

assertion. Finally, courts should rigorously supervise patent damages awards to make sure

that damages are proportionate to the value of the patented technology (Lemley and Shapiro,

2007). These reforms should not harm genuine inventors who crave publicity rather than

secrecy, and who should still be able to obtain broad, but clear patent protection.

It is also instructive to look for policy reforms suggested by the law and economics

analysis of the generic problem of frivolous lawsuits. One promising policy reform is greater

use of fee-shifting to favor defendants in cases brought by trolls. Allison et al. (2010) find

that troll patents fare poorly in court. The bargaining power of a troll seeking a nuisance

settlement would be great diminished in an aggressive fee-shifting regime. Similarly, more

23

stringent pleading requirements have been justified in other areas of the law as a method of

reducing frivolous lawsuits; this strategy might also work for patent litigation (Blaze, 1990).

Conclusion

Using these survey data and the associated database of NPE litigation our major

findings are these:

- The direct costs of NPE patent assertions are substantial, totaling about $29

billion accrued in 2011. This figure does not include indirect costs to the

defendant’s business such as diversion of resources, delays in new products,

and loss of market share. Even so, the direct costs are large relative to total

business spending on R&D, which totaled $247 billion in 2009 (NSF 2012),

implying that NPE patent assertions effectively impose a significant tax on

investment in innovation.

- Much of this burden falls on small and medium-sized companies who make

up 90% of the companies sued, accounting for 59% of the defenses, and

who pay about 37% of the direct costs. The median revenue of companies

sued by NPEs is $10.8 million. NPE litigation costs smaller companies more

relative to their revenues. In addition, smaller companies pay relatively more

to NPEs from assertions that do not go to court. The burden of all of these

costs appears to rebut the assertions that NPEs play an important role in

improving the profits of innovative start-ups.

- About a third of the cost to defendants involves patent assertions that do not

go to court. Moreover, we have likely underestimated these costs because we

24

have not surveyed small companies that do not also have NPE patent

litigation.

- NPEs appear to be highly heterogeneous. Much of the litigation appears to

consist of nuisance suits that settle for a few hundred thousand dollars. But

some NPEs are “big game hunters” who seek and get settlements in the tens

or hundreds of million dollars.

- Much of the cost to defendants implies a net loss of social welfare. About

one quarter of the cost of NPE litigation consists of legal fees. Of the total

direct cost, no more than a quarter could possibly represent a flow to fund

innovative activity.

25

References

Allison, John R., Mark A. Lemley and Joshua Walker, 2009. “Extreme Value or Trolls on

Top? Evidence From the Most-Litigated Patents,” Univeristy of Pennsylvania Law

Review, 158, pp. 101-37.

Allison, John R., Mark A. Lemley and Joshua Walker. 2010. “Patent Quality and Settlement

Among Repeat Patent Litigants,” Georgetown Law Journal, 99, pp. 677-712

American Intellectual Property Law Association. 2011. “AIPLA Report of the Economic

Survey.”

Bessen, James and Michael J. Meurer. 2008. Patent Failure: How judges, bureaucrats and lawyers put

innovators at risk, Princeton, NJ: Princeton University Press.

Bessen, James, Jennifer Ford and Michael J. Meurer. 2011. “The Private and Social Costs of

Patent Trolls,” Regulation, Winter 2011-2012, 26-35.

Bessen, James and Michael J. Meurer (2012), “The Private Costs of Patent Litigation,”

Journal of Law, Economics & Policy, forthcoming.

Blaze, Douglas, A. 1990. “Presumed Frivolous: Application Of Stringent Pleading

Requirements In Civil Rights Litigation,” William and Mary Law Review, 31, pp.

935-991.

Chien, Colleen, 2009. “Of Trolls, Davids, Goliaths, and Kings: Narratives and Evidence in

the Litigation of High – Tech Patents,” North Carolina Law Review, 87, pp. 1571-

1615

Federal Trade Commission, 2011. “The Evolving IP Marketplace: Aligning patent notice and

remedies with competition.”

Feldman, Robin Cooper and Thomas Ewing, The Giants Among Us, Stanford Technology

Law Review, Vol. 1, 2012

Fischer, Timo and Joachim Henkel. 2011. “Patent Trolls on Markets for Technology: An

Empirical Analysis of Trolls’ Patent Acquisitions” working paper.

Geradin, Damien, Anne Layne-Farrar and A. Jorge Padilla, Elves or Trolls? The Role of

Non-Practicing Patent Owners in the Innovation Economy, TILEC Discussion

Paper No. 2008-018, May 23, 2008

Hosie, Spencer, 2008. “Patent Trolls and the New Tort Reform: A Practitioner's

Perspective,” A Journal of Law & Policy for the Information Society, 4, pp. 75-87.

Kesan, Jay P. and Gwendolyn G. Ball. 2005. “How Are Patent Cases Resolved? An

Empirical Examination of the Adjudication and Settlement of Patent Disputes,” U.

Illinois Law & Economics Research Paper No. LE05-027.

26

Lemley, Mark A. and Carl Shapiro. 2007. “Patent Holdup and Royalty Stacking,” Texas Law

Review, 85, pp. 1991-2049.

Love, Brian J., 2010. “An Empirical Study of Patent Litigation Timing: Could a Patent Term

Reduction Decimate Trolls Without Harming Innovators?,” Working paper.

Magliocca, Gerard N. 2007. “Blackberries and Barnyards: Patent Trolls and the Perils of

Innovation,” Notre Dame Law Review, 82(5), 1809-1838.

McDonough, James F. III, 2006. “The Myth of the Patent Troll: An Alternative View of the

Function of Patent Dealers in an Idea Economy,” Emory Law Journal 56, pp189-

211.

Merges, Robert P., The Trouble with Trolls: Innovation, Rent-Seeking and Patent Law

Reform, November 18, 2011.

Morgan, Marc, 2008. “Stop Looking Under the Bridge for Imaginary Creatures: A Comment

Examining Who Really Deserves The Title Patent Troll,” Federal Circuit Bar

Journal, 17, pp. 165-80.

Myhrvold, Nathan, 2010. “The Big Idea,” Harvard Business Review, March 2010, pp. 40-50.

NSF, http://www.nsf.gov/statistics/seind12/

c4/c4h.htm

Patent Freedom. 2012. “Litigations Over Time,” available at:

https://www.patentfreedom.com/

about-npes/litigations/.

A. Mitchell Polinsky and Steven Shavell, Costly Litigation and Optimal Damages, available at:

http://ssrn.com/abstract=1990786 (2012).

Risch, Michael, 2012 forthcoming. “Patent Troll Myths,” Seton Hall Law Review, 42.

RPX. 2012. “US Litigations Involving NPEs,” available at:

http://www.rpxcorp.com/

index.cfm?pageid=45.

Schwartz, David L. 2012. “The Rise of Contingent Fee Representation in Patent Litigation,”

Alabama Law Review, forthcoming.

Shrestha, Sannu K. 2011. “Trolls or Market-makers? An empirical analysis of nonpracticing

entities,” Columbia Law Review, 110, pp. 114-60.

Tucker, Catherine, Patent Trolls and Technology Diffusion, December 24, 2011, available

at: http://papers.ssrn.com/sol3/

papers.cfm?abstract_id=1976593.

27

Tables and Figures

28

29

30

31

32

Figure 1.

Source: RPX database

33

Figure

2.

Cumulative

Distribution

of

Total

Direct

Litigation

Cost

by

Company

Size

Note:

Horizontal

axis

is

logarithmically

scaled.

Distributions

are

fit

with

lognormal

cumulative

distribution

functions.

The

distributions

are

for

resolved

lawsuits.

34

________________________________

________________________________

1 These figures come from the RPX database described below. About 4% of these defenses were mounted as

declaratory actions rather than infringement suits; these were nevertheless initiated by the NPEs. The figure for

2011 reflects, to some extent, an effort by NPEs to initiate litigation before the America Invents Act took

effect, restricting multi-party lawsuits. Nevertheless, the trend shown in Figure 1 illustrates rapid growth before

2011.

2 The survey was conducted by RPX, a firm that helps companies manage risk from exposure to patent

litigation. The Coalition for Patent Fairness reimbursed RPX for part of the expense of conducting this survey.

3 Indirect costs captured by our event study methodology include the opportunity costs of the effort exerted

legal, managerial, engineering, and scientific personnel inside the firm, and other business disruption costs such

as loss of goodwill, loss of market share, or disruption of innovative activities.

4 This includes Allison et al. (2010), Chien (2009), Love (2010), Risch (2012), Schwartz (2012), and Tucker

(2012). Other studies have looked at the characteristics of NPE patents asserted in lawsuits, including Shrestha

(2010), Allison et al. (2009), Risch (2012), and Fischer and Henkel (2011).

5 Although RPX provided data for this study, RPX did not exercise control over the substance of our text.

6 This database does not include patent disputes before the International Trade Commission.

7 There are a range of views among scholars and policy-makers about the appropriate definition of NPE, and

different analysts are likely to assembly different NPE litigation databases. Based on our experience researching

patent litigation, we believe that the RPX database yields statistics that are consistent with information about

NPE patent litigation from other sources.

8 To preserve data confidentiality, statistical analysis was performed by RPX personnel working under our

direction.

9 Readers should be mindful of the distinction between the industry of the defendant and the technology

covered by the patent asserted by the NPE. In particular, it is important to recognize that problematic software

patents are often asserted against hardware manufacturers.

10 If, instead, we look only at firms with reported revenue, 66% are small, accounting for 33% of the defenses.

11 In the survey estimated legal costs for a particular case were specified as: “Value of any legal costs related to

this matter through December 31, 2011. Include outside counsel (lead and local), experts, discovery costs, prior

art searching, jury consultants, graphics, other expenses, and other related costs. Include any costs that were

ultimately recouped or expected to be recouped by indemnification agreements or other mechanisms. Exclude

in-house legal costs.”

12 In the survey estimated settlement costs for a particular case were specified as: “Value of settlement. If a

running royalty, estimate the present value of royalties. If there was an exchange of patents or other nonstandard

deal structure then estimate expected present value cost of that deal..” Settlement costs include

damage awards in a small number of cases.

13 Weighting the ratios in Table 2 to represent the relative weights of small and large companies in the total

database, legal costs are 23% of the total and licensing costs are 77%.

14 The indirect costs of NPE lawsuits, such as those measured by Tucker (2011) and Bessen et al. (2011) are

likely to be a more significant source of deadweight loss.

15 For the middle range, the estimated costs are $1.6 million through discovery and $2.8 through trial.

16 In fact, we calculated aggregate costs using the data in Table 2, including the software/hardware categories.

These estimates came out about 5-10% higher than those reported in Table 4.

17 Regressions are reported in the Appendix. We used a regression that also included a dummy variable for

firms with less than $100 million in revenue in order to capture a non-linearity in the relationship between log

cost and log revenue. The predicted mean cost per litigation was $1.527 million for small/medium firms and $5.641 million for large firms. We also ran regressions using hardware/software dummy variables, however, the

coefficients on these dummies were not statistically significant.

18 These are $3.17 million for small/medium firms and $7.59 million for large firms.

19 RPX gathered revenue data from financial statements of publicly listed firms as well as estimates based on

information such as number of employees available for private firms. Revenues were not reported when a

private firm could not be definitely identified in their data sources.

20 As a point of comparison, Polinksy and Shavell calculate “the litigation costs associated with the U.S. tort

system are approximately $46 billion per year.”

21 We also caution readers not to rely on intuition based on the median cost of defending against NPE patent

assertions. Median cases are “typical” but of course it would not be correct to multiply the median cost by the

number of assertions to calculate aggregate costs numbers.

22 Not all of these firms were publicly listed all years. Note that we perform a similar exercise in Bessen et al.

(2011).

23 To calculate accrued costs from lawsuits already filed, we divide revenue by .75. That is, since 75% of

lawsuits in the total database are unresolved (Table 1), we assume that these NPE firms have so far received

only 75% of the revenue they will receive from the lawsuits already filed.

24 Bessen and Meurer (2012) find that the hazard of being sued increases with firm R&D.

25 “To some the use of the troll “moniker might be considered derogatory, [but] recently, in Highland Plastics,

Inc. v. Sorensen Research and Development Trust, 11-cv-2246 (C.D.Ca. Aug. 17, 2011), the court denied a

motion to strike the term “patent troll” from the complaint, stating that patent troll “is a term commonly used

and understood in patent litigation and is not so pejorative as to make its use improper.” Id., Dn. 21 at 3.”

Ralph Dengler, Is It Open Season Now for NPEs? IPLaw Alert, Oct. 31, 2011, available at:

http://www.iplawalert.com/2011/10/

articles/patent-1/

is-it-open-season-now-for-npes/

35

|