Joe Mullin at ars technica has the welcome news that the FTC is thinking about using subpoena powers to investigate patent trolls, such as Intellectual Venture. He mentions that Google, Red Hat, Blackberry and Earthlink just sent some comments [PDF] to the FTC and the Department of Justice asking for an investigation into what they politely call patent assertion entities, or PAEs. So have the Computer and Communications Industry Association [Comments, PDF] and the National Restaurant Association [Comments, PDF] also asked for such scrutiny. But the most important part of the Google et al. request, to me, hasn't yet been highlighted in the media reports I've seen. What they are asking for is not just an investigation into trolls, but into active companies outsourcing their patent enforcement *to* PAEs. And what they are asking for is whether such activities in some instances can rise to the level of antitrust violations. That is something I've wondered about for a while -- why didn't regulatory bodies see what is happening to Android, for example, with all the old guard working apparently together to try to crush it? One thing that Microsoft and Nokia have done, for example, is outsource patent enforcement to MOSAID and other patent enforcement-style non-practicing entities. (If you recall, Google filed a compliant specifically about that with the EU Commission last summer.) The new comments call the new outsourcing to trolls patent privateering, which they say is designed for assymetric patent warfare -- meaning the defendant's business is at stake, but the outsourcing company's business isn't, and the troll has nothing to lose, because it has no business. So, finally, the day I've been waiting for begins.

I've taken the time to do the comments as text for us, because the footnotes alone are a treasure trove of resources. So let's take a look at the antitrust issues and see if we can learn something about antitrust law that way.

Jump To Comments

Groklaw has a permanent page on Legal Research, with various categories represented, and one is antitrust law, including Andy Updegrove's extensive collection of resources as well as the

FTC antitrust guidelines, including a page on antitrust laws. So that's our foundation for how it all works.

Keep in mind that just as in fashion, there can be changes in antitrust law, depending on the administration. During the Bush years, antitrust was basically on life support, at best. Folks did as they pleased, pretty much. Now, there's been a shift and regulators are more active. But antitrust is a high bar, nonetheless, but that's not the only angle the FTC use: The Federal Trade Commission Act bans "unfair methods of competition" and "unfair or deceptive acts or practices." The Supreme Court has said that all violations of the Sherman Act also violate the FTC Act. Thus, although the FTC does not technically enforce the Sherman Act, it can bring cases under the FTC Act against the same kinds of activities that violate the Sherman Act. The FTC Act also reaches other practices that harm competition, but that may not fit neatly into categories of conduct formally prohibited by the Sherman Act. Only the FTC brings cases under the FTC Act. Ah. Unfair methods of competition. That sounds promising, at least. And

here's why it makes sense that the comments were sent to both the FTC and the DOJ, from the FTC's page on enforcement:Both the FTC and the U.S. Department of Justice (DOJ) Antitrust Division enforce the federal antitrust laws. In some respects their authorities overlap, but in practice the two agencies complement each other. Over the years, the agencies have developed expertise in particular industries or markets. For example, the FTC devotes most of its resources to certain segments of the economy, including those where consumer spending is high: health care, pharmaceuticals, professional services, food, energy, and certain high-tech industries like computer technology and Internet services. Before opening an investigation, the agencies consult with one another to avoid duplicating efforts. In this guide, "the agency" means either the FTC or DOJ, whichever is conducting the antitrust investigation.

According to IAM's most recent tally in February, by the way, the owners of the 10 biggest active US patent portfolios (in order): Samsung, IBM, Canon,

Panasonic, Sony, Toshiba, Hewlett-Packard, Hitachi, Microsoft

and Intel. So the problem isn't just trolls. Just saying.

Tim Worstall at Forbes claims that PAEs are good for us, maybe, a natural division of labor, so that companies can outsource to specialists and keep doing what they do best in house. First, the article doesn't forget to mention this, but it answers it by noting that the Commission says the putative rewards are uncertain and outweighed by the negative impact. The real issue raised by the comments, however, isn't whether the pluses outweigh the negatives; it's whether companies that are in business to sell products but outsource patent enforcement to trolls are violating US antitrust laws: II. Patent Transfers To PAEs Create Additional Perils

An accelerating phenomenon threatens to exacerbate the above-described harms and poses additional perils to competition and innovation. Although operating companies have consistently raised concerns about PAEs,53 some such companies increasingly employ PAEs as patent enforcement surrogates. These operating companies sell or assign pieces of (or entire) patent portfolios to PAEs that then assert the acquired patents against the transferring company’s rivals. Put differently, although operating companies previously funded certain PAE activities and served as a well-spring for patents PAEs enforce,54 operating companies are increasingly employing PAEs to strategic ends in new and evolving relationships.

The evolving relationships between operating companies and PAEs pose numerous distinct threats to innovation, competition and consumers. We describe several noteworthy harms below: (i) how transfers from operating companies to PAEs can harm innovation and raise rivals’ costs by altering enforcement incentives; (ii) how patent outsourcing arrangements can foster exploitation by facilitating evasion of no royalty stacking commitments in some industries; and (iii) how contractual arrangements between operating companies and PAEs can further exclusionary ends. Unfortunately, these are but a few examples of the many ways operating companies and PAEs interact that may implicate competition policy and our nation’s antitrust laws.55

_________

53 See , e.g., Tim Frain, Nokia Response to Patent Standards Workshop, Project No., P11-1204, at 5 (July 8, 2011), (“From a policy and regulator’s perspective, the role and impact of NPEs on legitimate enterprise perhaps deserves more careful attention.”), available at http://www.ftc.gov/os/comments/patentstandardsworkshop/00032-60891.pdf; Horacio Gutierrez, The SHIELD Act: Another Step in the Patent Reform Discussion, Technet (Feb. 27, 2013), http://blogs.technet.com/b/microsoft_on_the_issues/archive/2013/02/27/the-shield-act-another-step-in-the-patent- reform-discussion.aspx (“Microsoft is harassed by PAEs as much as anyone in our industry: at any given moment, we face as many as 60 PAE suits, comprising the vast majority of patent cases brought against us.”).

54 See generally Tom Ewing & Robin Feldman, The Giants Among Us, 2012 STAN. TECH. L. REV. 1, at ¶¶ 4-5 (2012) (describing how operating companies funded PAEs and how “mass aggregators purchase large chunks, even the majority, of an operating company’s patents and patent applications”), available at http://stlr.stanford.edu/pdf/feldman-giants-among-us.pdf.

55 Another harm not discussed at length here includes how certain PAEs’ accretion of massive patent portfolios might anticompetitively shield weak patents.

Other issues raised include this about evading FRAND commitments:

Operating companies and PAEs may engage in joint ex post exploitation. Certain transfers from operating companies to PAEs threaten to evade FRAND commitments even when, consistent with In re N-Data, the PAE agrees to honor a specific FRAND commitment made by the transferor.72 In particular, in some industries, operating companies that have made specific commitments to avoid royalty stacking may, in tandem with PAEs, be evading those commitments. The result, as with other transfers to PAEs, is to “raise prices and decrease incentives to innovate.”...

Similarly, commitments to royalty caps or FRAND licensing secured by certain industry participants from rights holders (whether through formal standard setting, unilateral commitments by patent holders, or otherwise) can mitigate royalty stacking concerns.78 Such assurances work to keep royalties reasonable once firms have adopted standardized technologies.79 One type of assurance is a “no stacking” pledge. Often this takes the form of a commitment by a rights holder not to seek more than a specific royalty level from implementers of particular standards no matter how many patents the rights holder possesses and no matter how many standards an implementer uses.80

15

“No stacking” commitments are common in some industries. A concrete example of such a pledge is one made by Nokia. To induce adoption of its proposed LTE standard, Nokia committed not to seek more than a 2.0% royalty for all of its patents “essential to wireless communication standards irrespective of the number of wireless standards deployed” and denominated this pledge a “no royalty stacking” commitment.81 Nokia’s commitment – and similar commitments of other cellular SEP holders – played a critical role in inducing the telecommunications industry to adopt its proposed LTE standard as a 4G cellular communications standard.82 SSOs facilitate “no stacking” commitments. The IEEE, for instance, permits firms with likely essential patents to commit to not-to-exceed license fees.83

Transferors can attempt to circumvent these no royalty stacking commitments by outsourcing the enforcement of patents to PAEs. Suppose an operating company, which holds 500 patents essential to implementing a certain technology, makes a “no stacking” commitment not to charge more than 2.0% royalty for a license to all of its 500 patents for use in the field to which they are essential. The operating company then transfers 300 of its 500 essential patents to three PAEs (100 each). Further suppose that, in a purported effort to comply with In re N-Data, each PAE agrees to be bound by the operating company’s 2.0% royalty cap. That promise may preclude each PAE from individually charging more than 2.0% for its 100 patents. But that promise may prove insufficient to prevent each PAE from charging that level. Thus, the effective royalty on the essential patent portfolio may end up being 8.0% in this situation, as the operating company and each PAE may attempt to charge up to 2.0%.84

16

In this example, by disaggregating and parceling out selected parts of its previously unified patent portfolio to PAEs, the operating company attempts to circumvent its “no stacking” commitment – indeed, its outsourcing creates the potential for the very royalty stacking by multiple rights holders that its “no stacking” pledge was designed to prevent.85 Well, well, that may put the currently fashionable whining by Microsoft and Apple et al. about Android vendors' allegedly charging too much for their FRAND patents into a fascinatingly hypocritical context, don't you think? And here's how the strategies work out to harm competitors, according to the comments:

C. Operating Companies Can Employ PAEs To Harm Competition

Firms may combine the above tactics with contractual commitments extracted from PAE transferees that facilitate anticompetitive strategies. For example, a firm that made a “no stacking” pledge to an SSO or to the industry at large might seek to evade that commitment in order to raise its rivals’ costs by parceling out pieces of a previously-unified portfolio to PAEs. Such PAE “privateers,” which do not confront the threat of patent countersuits, have a greater ability and incentive to target the firm’s rivals than the transferring firm, and the ability to evade a “no stacking” pledge can inflict further harms. The transferring operating company, however, might seek to further incentivize its PAE enforcement agents to target rivals through contractual mechanisms. Such provisions, in effect, can give the operating company continuing influence over the PAE, resulting in what Professor Carl Shapiro, at the FTC/DOJ PAE hearings, called a “Hybrid PAE.”87

Examples of such mechanisms might include, among others, a continuing royalty for the benefit of the transferring operating company coupled with a right by the transferring operating company to take the patents back. If a firm sells patents to a PAE (or transfers an exclusive right to sue for a lump sum royalty) the transferring firm might not maintain influence over the PAE’s

17

subsequent enforcement actions. By contrast, if the PAE must pay the transferring firm a running royalty and the transferring firm retains the right to take the patents back if the royalties are insufficient, such provisions might give the PAE an additional incentive to act in the transferring firm’s strategic interest. This may lead the PAE to target specific rivals of the transferring operating company for patent enforcement and thereby facilitate a rival’s cost-raising strategy by the transferring operating company.

Another mechanism for channeling a PAE’s enforcement activities to serve the transferring firm’s strategic interests is a specific agreement on enforcement targets or retained licenses to the transferred patents that protect the transferring firm’s customers or strategic allies. For example, if a firm selling an intermediate product sought to arm a PAE against purveyors of competing intermediate products, it could transfer patents to the PAE while retaining licenses that shield its customers from suit. Under those restraints, the PAE could only target customers’ implementations of the transferring firm’s competitors’ intermediate products. Customers might favor the transferring firm’s products because they benefit from the retained license and because they can avoid the cost of litigation brought by the PAE.

In other words, an operating company can employ what are in effect PAE partners to raise rivals’ costs.88 The threat of strategic outsourcing to raise rivals’ costs, moreover, has become more acute. Preliminary statistics suggest that patent enforcement outsourcing is becoming increasingly prevalent.89 The exclusionary impact may be relatively larger when rivals are small and not well funded. PAEs’ most frequent enforcement targets are small- and medium-sized firms. One survey found firms with under $10 million in annual revenue represented 55% of PAE defendants, and firms with under $100 million in annual revenue represented 66% of total patent defendants.90 And a common opinion is that PAEs “with weaker patents often target small companies that cannot afford the legal fees required to defend a patent infringement matter in court” and those companies may “opt to pay the demanded license fee rather than defend to avoid the expense of litigation that could dwarf the amount of the demanded license fee.”91 The concern with firms employing PAE vassals to target rivals may be exacerbated by the secrecy with which PAEs conduct their operations. Amen. I hope the FTC follows through. What they asked for specifically, then, is a Section 6(b) study of PAEs that includes a

focus on patent transfers from operating companies. Here's what that is,

15 USC § 46, titled "Additional Powers of Commission", and look at paragraph b, colloquially called 6(b):(b) Reports of persons, partnerships, and corporations

To require, by general or special orders, persons, partnerships, and corporations, engaged in or whose business affects commerce, excepting banks, savings and loan institutions described in section 57a (f)(3) of this title, Federal credit unions described in section 57a (f)(4) of this title, and common carriers subject to the Act to regulate commerce, or any class of them, or any of them, respectively, to file with the Commission in such form as the Commission may prescribe annual or special, or both annual and special, reports or answers in writing to specific questions, furnishing to the Commission such information as it may require as to the organization, business, conduct, practices, management, and relation to other corporations, partnerships, and individuals of the respective persons, partnerships, and corporations filing such reports or answers in writing. Such reports and answers shall be made under oath, or otherwise, as the Commission may prescribe, and shall be filed with the Commission within such reasonable period as the Commission may prescribe, unless additional time be granted in any case by the Commission. This section makes it ideal, the comments say, for investigating what is going on:We accordingly recommend that the FTC employ its authority under Section 6(b) of the FTC Act, 15 U.S.C. § 46, to initiate an inquiry into the relationship between PAEs and operating companies – whether as a discrete topic or as part of a broader Section 6(b) inquiry into PAEs. A Section 6(b) inquiry will enable the Commission to probe this important area and answer many important questions. For example:

- How prevalent is the outsourcing of patent enforcement by operating companies to PAEs?

- What types of arrangement have PAEs and operating companies consummated?

- What motivates these arrangements?

- What are the likely competitive harms and benefits of patent outsourcing?

- What are the competitive implications of the secrecy with which many PAEs conduct their operations?

- Do the particular terms of outsourcing arrangements indicate that operating companies are employing PAE proxies as competitive weapons?

A Section 6(b) inquiry focused on these and other questions would enable the Commission and the public to deepen their understanding of how operating companies’ arrangements with PAEs affect innovation, competition and consumers.10 The fruits of a Section 6(b) inquiry also would provide a foundation for the antitrust agencies to assess whether the solutions to the competitive concerns patent outsourcing arrangements pose lie in antitrust enforcement, in changes in the patent laws (where the antirust enforcement agencies might play an important advocacy role), or elsewhere. So when you read Joe's piece on two FTC members saying they are considering using subpoena powers, know that it didn't happen out of a clear blue sky.

Here it is, as text, and you can get the footnotes from there. You don't want to miss footnote 36.

**************

COMMENTS OF GOOGLE, BLACKBERRY, EARTHLINK & RED HAT TO THE

FEDERAL TRADE COMMISSION AND U.S. DEPARTMENT OF JUSTICE

on

PATENT ASSERTION ENTITIES

Submitted via email: ATR.LPS-PAEPublicComments@usdoj.gov

Comments to the Federal Trade Commission and

Department of Justice on Patent Assertion Entities

INTRODUCTION

The Commission recognizes that Patent Assertion Entities (“PAEs”) jeopardize the patent system’s central purpose of encouraging innovation. In its 2011 Evolving IP Marketplace Report, the Commission observed that PAEs’ accumulation and assertion of patents impose costs that threaten to “distort competition in technology markets, raise prices and decrease incentives to innovate.”1 The Commission further expressed skepticism that PAEs produce the benefits that their proponents claim or that any such benefits justify the harms that PAEs inflict.

The Commission’s skepticism appears well-founded. We believe that many PAE activities are inconsistent with the fundamental goal of the patent system – that is, “to Promote the Progress of Science and the Useful Arts.”2 In particular, PAEs impose an ever-rising “tax” on innovative industries. The facts are sobering:

- PAEs are filing four times as many cases today as in 2005.

- PAE lawsuits now account for 62% of all recently filed patent litigation.

- Big tech companies face hundreds of PAE lawsuits, but small- and medium-sized companies are the most frequent targets.

- PAE claims cost U.S. companies $29 billion in 2011; $80 billion when accounting for all costs – direct and indirect.

- Although the Supreme Court’s decision in eBay limits PAEs’ ability to obtain injunctions in district court, PAEs continue to Seek exclusion orders in the ITC.

- PAEs also continue to take advantage of information asymmetries that stem from poor notice and inadvertent infringement to appropriate sunk costs from firms locked into product design choices.

We therefore applaud the Commission’s and the Antitrust Division’s decision to hold a joint workshop on patent assertion entities that builds upon the Commission’s work from 2011. As the Commission noted in its 2011 Report, “[t]wo areas of patent law” – notice and remedies – “impact how well the patent system and competition policy work together to further their common goal of enhancing consumer welfare.”3 Without “clear notice of what a patent covers,” and what patents exist, firms may be unsure about the potential risks of developing and

1

commercializing high-tech products.4 “Poor patent notice undermines innovation and competition by raising the risk of . . . infringement and imposing ‘a very high overhead’ on innovation.”5 The Commission recognized, moreover, that the current state of the law regarding patent infringement remedies “encourage[es] patent speculation, ex post licensing and ‘being infringed’ as a business model.”6 PAEs, in particular, are exploiting fuzzy patent boundaries and targeting “inadvertent infringers”7 to extract economic rents that often far exceed the value of the underlying technologies. A patent system that enables the appropriation of sunk costs through excessive rents and “[d]amage awards that do not track the value of a patented invention compared to alternatives can deprive consumers of the benefits of competition among technologies.”8

Although we agree that the current patent system undesirably encourages PAE activity, we are also concerned with, and suggest that the agencies should seriously examine, the outsourcing of patent enforcement by operating companies – companies that develop technology and sell products – to PAEs and the competitive implications of such activities. So-called “privateering”9 amplifies the threat to innovation and competition already posed by PAEs.

PAEs long have sought to acquire IP rights from operating companies. And operating companies long have served as targets of PAEs’ patent enforcement efforts. Today, however, we are witnessing an important shift in the relationship between certain operating companies and PAEs. Some operating companies appear to be outsourcing patent enforcement to PAEs and providing incentives to those PAEs to enforce patents against the transferring company’s rivals. Privateering poses numerous perils to competition, consumers and innovation.

First, operating companies’ outsourcing of patent enforcement to PAEs detrimentally alters enforcement incentives. When, for example, two operating companies each possess patents that implicate the other’s products, a common outcome is cross-licensing. Cross- licensing, particularly at low royalty levels that “net out” the value of respective IP rights, benefits competition and consumers. Cross-licensing resolves blocking positions, reduces costs and promotes the dissemination of technology and innovation. Conversely, the threat of patent countersuits may also deter firms from enforcing patents against one another. Such “mutual assured destruction” can achieve many of the same benefits as cross-licensing.

2

Outsourcing to PAEs alters these incentives in ways that raise costs and harm competition. Unlike an operating company, most PAEs are immune to patent countersuits because they offer no products or services. Transferring patents to a PAE can shift symmetric patent peace into asymmetric patent aggression. Indeed, by outsourcing enforcement of part of its patent portfolio to a PAE, an operating company can try to have it both ways: The operating company can continue to deter patent suits by another operating company by virtue of its remaining patents; and it can encourage offensive actions against its rivals through strategic patent transfers to a PAE (which need not fear patent countersuits). Moreover, by outsourcing part of its portfolio to PAEs while retaining a stake in the outcome, an operating company may extract value from its own patents that it otherwise might not have been able to achieve. And although outsourcing can be met in kind, escalating patent conflicts through mutual PAE outsourcing merely imposes additional costs that ultimately harm consumers.

Second, in some industries, patent outsourcing arrangements between operating companies and PAEs can threaten royalty stacking and result in exploitation. In the standard-setting context and in other contexts, some patent holders make “no royalty stacking” pledges to induce Standard Setting Organizations (“SSOs”) and industry participants to adopt their technology over alternatives. In a “no stacking” commitment, a company pledges that, no matter how many of its patents implicate a particular technology or standard, the company will only Seekroyalties up to a certain level. By transferring patents essential to implement the committed technology to multiple PAEs, a company can Seekto evade its no royalty stacking commitment. This can occur when, despite agreements by each PAE individually to honor the operating company’s royalty cap, there is no obligation by the PAEs and operating company collectively to honor the cap. Disaggregation of a patent portfolio to PAEs thus can enable the very royalty stacking that a patent holder’s “no stacking” pledge was designed to prevent. Moreover, when a breach of the “no stacking” commitment occurs after an industry becomes locked into a standard, outsourcing patents subject to a no royalty stacking commitment to PAEs may result in the very type of exploitation the Commission condemned in In re N-Data and sought to arrest in Rambus.

Third, operating companies may combine the above tactics with contractual commitments secured from their PAE surrogates to raise rivals’ costs and thereby harm competition and stifle innovation. An operating company might parcel out pieces of a previously-unified patent portfolio to multiple PAEs pursuant to terms that give the PAEs significant incentives to raise rivals’ costs. For example, an operating company might retain the right to pull back the transferred patents if royalties secured by PAEs do not meet certain milestones. Or the transferring operating company and PAEs might agree to target the transferring operating company’s rivals. The operating company thereby may succeed in saddling rivals with additional costs that enable the transferring company (or its allies) to exercise market power.

These arrangements (and others) between operating companies and PAEs can, depending on the facts, transgress the antitrust laws. Patent acquisitions by PAEs from operating companies are subject to Section 7 of the Clayton Act, as well as the Sherman Act. Schemes by which operating companies outsource patents to PAE proxies to raise rivals’ costs may be subject to invalidation under Sherman Act Section 1 and Section 2. And, depending on the circumstances, employing PAE enforcement agents to evade FRAND commitments (including no royalty

3

stacking pledges) may violate precedent under Section 5 of the FTC Act as well as the Sherman Act.

We accordingly recommend that the FTC employ its authority under Section 6(b) of the FTC Act, 15 U.S.C. § 46, to initiate an inquiry into the relationship between PAEs and operating companies – whether as a discrete topic or as part of a broader Section 6(b) inquiry into PAEs. A Section 6(b) inquiry will enable the Commission to probe this important area and answer many important questions. For example:

- How prevalent is the outsourcing of patent enforcement by operating companies to PAEs?

- What types of arrangement have PAEs and operating companies consummated?

- What motivates these arrangements?

- What are the likely competitive harms and benefits of patent outsourcing?

- What are the competitive implications of the secrecy with which many PAEs conduct their operations?

- Do the particular terms of outsourcing arrangements indicate that operating companies are employing PAE proxies as competitive weapons?

A Section 6(b) inquiry focused on these and other questions would enable the Commission and the public to deepen their understanding of how operating companies’ arrangements with PAEs affect innovation, competition and consumers.10 The fruits of a Section 6(b) inquiry also would provide a foundation for the antitrust agencies to assess whether the solutions to the competitive concerns patent outsourcing arrangements pose lie in antitrust enforcement, in changes in the patent laws (where the antirust enforcement agencies might play an important advocacy role), or elsewhere.

I. PAEs Continue To Hinder Innovative Industries

The threat that PAEs pose to innovative industries continues to grow. The Commission’s 2011 IP Report explained how PAEs impose an ex post “tax” on innovation. When a PAE asserts a patent obtained from a third party against a manufacturer, “[a] manufacturer’s royalty payment may raise costs to consumers, but it obtains only the avoidance of infringement litigation, not the benefit of the technology itself.”11 Put differently, the “manufacturer’s costs will increase and its return on investment will decrease after it has developed and commercialized a product.”12 In short, by See king to hold up firms that have commercialized

4

products, PAEs threaten to “distort competition in technology markets, raise prices and decrease incentives to innovate.”13

Many others have described PAEs’ harmful effects on innovation. Some have argued that “PAEs represent a ‘socially wasteful’ business activity, diverting resources from more useful areas to the fora of litigation.”14 President Obama recently called PAEs a “classic example” of firms that “don’t actually produce anything themselves. They’re just trying to essentially leverage and hijack somebody else’s idea and see if they can extort money out of them.”15 President Obama suggested that “smarter patent laws” might be one possible solution to the problem.16 Google has proposed that “Congress should [] make it easier for companies to recover money spent defending against frivolous troll suits” by passing legislation similar to “the bipartisan SHIELD Act” and “expanding the covered business method program of the America Invents Act to include more patents.”17 Still others suggest that the President could encourage “increase[d] antitrust scrutiny” of PAEs that are, in essence, imposing “a startup tax across the tech sector.”18

Recent data indicate that the number of exploitative suits and economic rents extracted by PAEs is growing dramatically and the worst is yet to come. Both the number of PAEs and the number of patents held by PAEs are increasing; PAE “innovation” in rent-extraction techniques is occurring rapidly and spreading by imitation. PAEs retain the threat of obtaining ITC exclusion orders even if eBay has eased the threat of a district court injunction. Without public policy reforms, the costs PAEs impose – in the form of defense costs, licensing fees and litigation awards – will continue to rise.

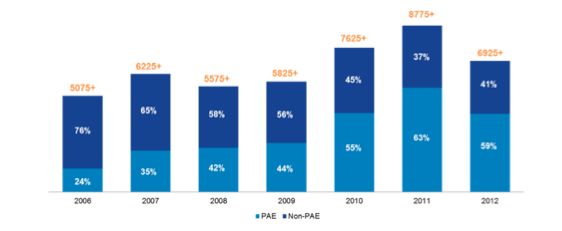

A. Patent Lawsuits Filed By PAEs Nearly Doubled from 2007 To 2011

The increase in lawsuits filed by PAEs over the last decade is dramatic. Last year, 4,125 of the 6,934 defendants (59%) named in patent cases were named by PAE plaintiffs.19 In 2011, operating companies mounted nearly 6,000 litigation defenses against PAEs, a more than 400%

5

increase since 2005.20 Today, lawsuits filed by PAEs account for 62% of all patent cases.21 The following graphs depict this dramatic increase in PAE-related litigation:

PAE Suits Have Become the Majority of All Patent Suits222

6

Number of PAE Defendants Has Increased Significantly In Recent Years23

PAEs have focused much of their attention and resources on the information technology (“IT”) industry. There are a number of reasons for this: (1) companies in the industry often enter bankruptcy or become so distressed they are willing to sell off their patents; (2) products in this field are often covered by many patents; and (3) IT patents, some assert, are relatively easy to procure as “paper inventions” – i.e., without constructing the underlying invention.24 As noted, however, PAE activities threaten to impose costs and hinder innovation in numerous other industries as well.

B. PAEs Continue To Seek ITC Exclusion Orders

Although the Supreme Court has limited PAEs’ ability to obtain injunctions in the federal courts,25 PAEs remain (as a result of the interpretation of “domestic injury”) able to seek exclusion orders in the International Trade Commission (“ITC”). While “the injunction grant rate post-eBay in district courts has declined to around 75 percent . . . the ITC’s injunction rate has held steady at 100 percent.”26 This reflects that “[p]arties who win in district court but would not receive an injunction under eBay can circumvent this response by refiling their cases in the

7

ITC because a district court’s denial of an injunction request is no barrier to the grant of an exclusion order by the ITC.”27

It is little wonder that PAEs have shifted their focus to the ITC. One set of scholars has observed that, because “nearly every patentee can bring an ITC complaint, and nearly every accused infringer is a potential ITC defendant,” the ITC has become the “mainstream venue in which to file patent grievances.”28 Indeed, the ITC’s “caseload has more than doubled, from 29 cases in 2005 to 64 [in 2011].”29 Based on a recent analysis, Professor Colleen Chien estimates that PAEs account for more than one-quarter of all patent cases filed in the ITC.30 “Growth in NPE-initiated ITC cases has outpaced that in ITC cases in general [from 2006 to 2011], with the NPE share of all ITC cases growing from 7% to 25% and the number of respondents from NPE-initiated ITC cases growing to over 50% of all ITC respondents.”31

Put differently, an “unintended consequence” of eBay has been to drive “patentees to the ITC in hopes of obtaining an injunction no longer available in the federal district courts.”32 In some instances, moreover, it appears that PAEs have employed operating company licensees’ activities to help establish domestic industry, a pre-requisite for a successful suit at the ITC.33

8

C. PAE Patent Enforcement Imposes A Tax On Innovation

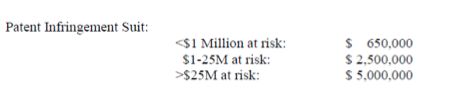

The explosion of PAE litigation has worked to raise the costs confronting innovative industries. One study found that PAEs have inflicted $500 billion in costs on publicly-traded companies since 1990, with total costs (including direct and indirect costs) of more than $83 billion per year over each of the past four years.34 In 2011, the “direct costs of [PAE] patent assertions . . . totaled about $29 billion . . . including the costs of non-litigated assertions.”35 These direct costs, which have doubled from 2009 to 2011 and have increased by 400% since 2005,36 include legal defense fees, licensing arrangements and monetary judgments, all of which have the consequences of diverting resources and delaying new products.37 The costs of defending a patent infringement suit are startling. According to industry estimates, the median cost of patent litigation breaks down as follows38:

These costs are merely the legal costs borne by defendants. Combine the legal costs with settlement costs, according to one source, and the “mean total litigation costs are $1.75 million for small/medium companies (defined as companies with less than $1 billion in reported revenue) and $8.79 million for large companies.”39 To understand the harmful impact of excessive litigation, one must add to these out-of-pocket costs the loss of time, energy and creativity of managers, engineers and scientists caught up in the litigation process.40

9

The prospect of incurring these substantial costs drives many defendants to settle even the most unmeritorious of claims.41 And these settlements are by no means trivial. In fact, “it is clear that non-litigated patent assertions are responsible for much of the direct costs imposed by [PAEs] on operating companies.”42 According to one source, the mean total cost per company for a non-litigated patent assertion – that is, the direct and indirect costs resulting from PAE enforcement and licensing efforts shy of litigation – is $42.4 million for large companies and $8.1 million for small/medium companies, averaging $29.8 million across all companies.43 PAEs, therefore, “have nothing to lose and much to gain by litigating aggressively”44 or demanding royalties based in large part on design-around costs.45

Despite the significant costs they inflict, a very small share of PAE revenues is used to support innovation or invention. For that reason, some researchers contend that “a substantial part of direct costs of [PAE] litigation is a deadweight loss to society.”46 They conclude that approximately only one quarter of PAE revenues flows to innovators “and at least that much go[es] toward legal fees.”47 Moreover, other empirical research concludes that “less than two percent of losses in wealth caused by PAEs passed through to independent inventors.”48 And only 29% of PAE patents come from small inventors; 43% come from large firms.49 Thus, although supporters contend that PAEs produce certain benefits – for example, efficiently dividing labor between innovators and experts in enforcement; enabling smaller firms and sole inventors to achieve a return on otherwise unmonetizable investments in innovation; facilitating efficient management of large IP portfolios50 – the Commission rightly described these benefits as “uncertain”51 and likely outweighed by the harms PAEs inflict.52

10

II. Patent Transfers To PAEs Create Additional Perils

An accelerating phenomenon threatens to exacerbate the above-described harms and poses additional perils to competition and innovation. Although operating companies have consistently raised concerns about PAEs,53 some such companies increasingly employ PAEs as patent enforcement surrogates. These operating companies sell or assign pieces of (or entire) patent portfolios to PAEs that then assert the acquired patents against the transferring company’s rivals. Put differently, although operating companies previously funded certain PAE activities and served as a well-spring for patents PAEs enforce,54 operating companies are increasingly employing PAEs to strategic ends in new and evolving relationships.

The evolving relationships between operating companies and PAEs pose numerous distinct threats to innovation, competition and consumers. We describe several noteworthy harms below: (i) how transfers from operating companies to PAEs can harm innovation and raise rivals’ costs by altering enforcement incentives; (ii) how patent outsourcing arrangements can foster exploitation by facilitating evasion of no royalty stacking commitments in some industries; and (iii) how contractual arrangements between operating companies and PAEs can further exclusionary ends. Unfortunately, these are but a few examples of the many ways operating companies and PAEs interact that may implicate competition policy and our nation’s antitrust laws.55

A. Outsourcing To PAEs Impairs Competition By Undermining Patent Peace

It is commonly recognized that cross-licensing benefits consumers and innovation.56 Cross-licenses remove blocking positions, facilitate the dissemination of technology, reduce

11

costs by reducing risk and uncertainty and foster innovation.57 Cross-licenses, in other words, are among the “ex ante” patent transactions that, as the Commission recognized in its 2011 IP Report, typically benefit competition.58 Moreover, when firms possess significant patent portfolios that may implicate one another’s products, those positions can serve to achieve consequences similar to a cross-license. One firm may be deterred from initiating patent litigation against another for fear of drawing a patent countersuit.59 Therefore, each firm’s possession of patents may foster “patent peace.” As one set of scholars put it, “When one has an insurmountable weapon, there is no need to use the weapon.”60

But in many circumstances, patent transfers to PAEs undermine patent peace and harm innovation, competition and consumers.61 The reason is that such transfers change incentives to enforce patents. For example, suppose two competitors (A and B) decline to sue one another because each knows that initiating patent litigation will draw a countersuit by the other. Firm A then outsources enforcement of some (but not all) of its patents to a PAE. As many commentators recognize, the PAE transferee has different incentives to assert the transferred patents than Firm A.62 PAEs are not operating companies and, therefore, are not vulnerable to patent countersuits when the PAE initiates litigation.63 Thus, where the prospect of patent countersuits deterred Firm A from suing Firm B, Firm A can avoid the deterrent effect of countersuits by transferring patents to a PAE with incentives to assert them against Firm B.

12

In other words, the transfer from Firm A to the PAE alters – potentially quite dramatically – the incentives to enforce the transferred patents. These altered incentives can increase costs. Before the patent transfer, Firm A and Firm B had strong incentives to include a cross-license in any patent dispute settlement. The cross-license likely would have reduced the amount of cash royalties flowing from one firm to the other, and in some circumstances it may have reduced royalty payments to zero. But transferring patents to the PAE undermines cross-licensing because the PAE places no value on access to other firm’s technologies. And by outsourcing enforcement of only part of its portfolio to the PAE,64 Firm A can attempt to deter Firm B from suing Firm A (because Firm A retains other patents potentially to assert against Firm B) while raising Firm B’s costs through outsourcing enforcement of other patents to the PAE. The secrecy that often shrouds transfers to PAEs may facilitate such tactics, by masking that the PAE obtained the patents from Firm A (at least where Firm A’s personnel are not inventors).65

Depending on the facts, transfers that change enforcement incentives may raise rivals’ costs and harm competition. A firm that refrains from unleashing a patent assault on a competitor for fear of countersuit – which leaves both firms competing vigorously against one another – might ship part of a patent portfolio to a PAE enforcement agent. Enforcement by the PAE enforcement proxy, in turn, might significantly raise the rival’s cost structure and thereby raise market-wide prices. Although not every patent transfer from an operating company to a PAE would threaten such consequences, the potential for anticompetitive harm in these transactions warrants investigation by the agencies.

B. Outsourcing Patent Enforcement Enables Exploitative Rent Seeking

A second and distinct way that operating company transfers to PAEs threaten competition is by enabling the company to evade its “no stacking” commitments, which are common in some industries.

The antitrust agencies long have sought to prevent patent holders from exploiting firms that reasonably relied on the patent holder’s patent declarations or licensing commitments. The Commission’s litigation efforts against Rambus and Unocal illustrate the FTC’s commitment to remedy, and thereby deter, the exploitation of firms induced to adopt technology based on such commitments made by patent holders.66 The Commission’s In re N-Data consent order sought to arrest another form of exploitation: When the transferee of a patent ignores the specific

13

FRAND commitment made by the transferor and seeks exorbitant rates against a locked-in industry.67 The Commission’s 2011 IP Report similarly recognized that PAEs’ acquisition of and enforcement of patents also can foster exploitation. The Commission wrote:

the harms associated with PAE activity are the harms associated with all ex post patent assertions against manufacturers that have independently created or obtained the technology . . . . Such transactions can distort competition in technology markets, raise prices and decrease incentives to innovate. The extent of PAE activity in the IT sector amplifies the potential harm there.68

The threat of PAE ex post assertions is magnified by the fact that many PAE patents are of questionable merit. PAEs only win 9.2% of the infringement suits they bring that actually reach trial (only 8% if default judgments are excluded).69 In contrast, operating companies win 40% of their cases that reach trial (50% if default judgments are included).70 Thus, in general, PAEs assert weak patents. Carl Shapiro recently demonstrated that “a large fraction of negotiated royalties” firms can extract using “weak patents covering a minor feature of a high-margin product that takes time to redesign” is attributable “to hold-up, not to the value of the patented technology.”71

Operating companies and PAEs may engage in joint ex post exploitation. Certain transfers from operating companies to PAEs threaten to evade FRAND commitments even when, consistent with In re N-Data, the PAE agrees to honor a specific FRAND commitment made by the transferor.72 In particular, in some industries, operating companies that have made specific commitments to avoid royalty stacking may, in tandem with PAEs, be evading those commitments. The result, as with other transfers to PAEs, is to “raise prices and decrease incentives to innovate.”73

14

Royalty stacking – or the “Cournot Complements problem” – can occur, for example, when multiple complementary patent holders seek to assert infringement by a single device.74 This theory holds that because each patent holder maximizes only its own revenue, each will seek to maximize the royalty owed to it, even though the overall effect is to reduce royalties for rights holders in the aggregate below optimal levels.75 These aggregate licensing costs might reduce overall output, and all patentees and manufacturers suffer from lower revenues; consumers suffer from reduced supply, limited features and higher prices.76

One procompetitive function of patent pools is to mitigate royalty stacking by combining complementary assets and licensing efficiently.77 Similarly, commitments to royalty caps or FRAND licensing secured by certain industry participants from rights holders (whether through formal standard setting, unilateral commitments by patent holders, or otherwise) can mitigate royalty stacking concerns.78 Such assurances work to keep royalties reasonable once firms have adopted standardized technologies.79 One type of assurance is a “no stacking” pledge. Often this takes the form of a commitment by a rights holder not to seek more than a specific royalty level from implementers of particular standards no matter how many patents the rights holder possesses and no matter how many standards an implementer uses.80

15

“No stacking” commitments are common in some industries. A concrete example of such a pledge is one made by Nokia. To induce adoption of its proposed LTE standard, Nokia committed not to seek more than a 2.0% royalty for all of its patents “essential to wireless communication standards irrespective of the number of wireless standards deployed” and denominated this pledge a “no royalty stacking” commitment.81 Nokia’s commitment – and similar commitments of other cellular SEP holders – played a critical role in inducing the telecommunications industry to adopt its proposed LTE standard as a 4G cellular communications standard.82 SSOs facilitate “no stacking” commitments. The IEEE, for instance, permits firms with likely essential patents to commit to not-to-exceed license fees.83

Transferors can attempt to circumvent these no royalty stacking commitments by outsourcing the enforcement of patents to PAEs. Suppose an operating company, which holds 500 patents essential to implementing a certain technology, makes a “no stacking” commitment not to charge more than 2.0% royalty for a license to all of its 500 patents for use in the field to which they are essential. The operating company then transfers 300 of its 500 essential patents to three PAEs (100 each). Further suppose that, in a purported effort to comply with In re N-Data, each PAE agrees to be bound by the operating company’s 2.0% royalty cap. That promise may preclude each PAE from individually charging more than 2.0% for its 100 patents. But that promise may prove insufficient to prevent each PAE from charging that level. Thus, the effective royalty on the essential patent portfolio may end up being 8.0% in this situation, as the operating company and each PAE may attempt to charge up to 2.0%.84

16

In this example, by disaggregating and parceling out selected parts of its previously unified patent portfolio to PAEs, the operating company attempts to circumvent its “no stacking” commitment – indeed, its outsourcing creates the potential for the very royalty stacking by multiple rights holders that its “no stacking” pledge was designed to prevent.85 Moreover, the gains from evading and exceeding the pledged rate cap by disaggregating a portfolio can exceed the deadweight loss from reduced licensed sales volume. The operating company and its transferees can then seek licensing fees that, in the aggregate, exceed the promised cap,86 thereby engaging in a form of exploitative rent seeking. The 2.0% “no stacking” pledge functioned as a form of FRAND commitment. By outsourcing enforcement to multiple PAEs, the operating company seeks to evade that commitment and shares in the resulting super-FRAND returns.

C. Operating Companies Can Employ PAEs To Harm Competition

Firms may combine the above tactics with contractual commitments extracted from PAE transferees that facilitate anticompetitive strategies. For example, a firm that made a “no stacking” pledge to an SSO or to the industry at large might seek to evade that commitment in order to raise its rivals’ costs by parceling out pieces of a previously-unified portfolio to PAEs. Such PAE “privateers,” which do not confront the threat of patent countersuits, have a greater ability and incentive to target the firm’s rivals than the transferring firm, and the ability to evade a “no stacking” pledge can inflict further harms. The transferring operating company, however, might seek to further incentivize its PAE enforcement agents to target rivals through contractual mechanisms. Such provisions, in effect, can give the operating company continuing influence over the PAE, resulting in what Professor Carl Shapiro, at the FTC/DOJ PAE hearings, called a “Hybrid PAE.”87

Examples of such mechanisms might include, among others, a continuing royalty for the benefit of the transferring operating company coupled with a right by the transferring operating company to take the patents back. If a firm sells patents to a PAE (or transfers an exclusive right to sue for a lump sum royalty) the transferring firm might not maintain influence over the PAE’s

17

subsequent enforcement actions. By contrast, if the PAE must pay the transferring firm a running royalty and the transferring firm retains the right to take the patents back if the royalties are insufficient, such provisions might give the PAE an additional incentive to act in the transferring firm’s strategic interest. This may lead the PAE to target specific rivals of the transferring operating company for patent enforcement and thereby facilitate a rival’s cost-raising strategy by the transferring operating company.

Another mechanism for channeling a PAE’s enforcement activities to serve the transferring firm’s strategic interests is a specific agreement on enforcement targets or retained licenses to the transferred patents that protect the transferring firm’s customers or strategic allies. For example, if a firm selling an intermediate product sought to arm a PAE against purveyors of competing intermediate products, it could transfer patents to the PAE while retaining licenses that shield its customers from suit. Under those restraints, the PAE could only target customers’ implementations of the transferring firm’s competitors’ intermediate products. Customers might favor the transferring firm’s products because they benefit from the retained license and because they can avoid the cost of litigation brought by the PAE.

In other words, an operating company can employ what are in effect PAE partners to raise rivals’ costs.88 The threat of strategic outsourcing to raise rivals’ costs, moreover, has become more acute. Preliminary statistics suggest that patent enforcement outsourcing is becoming increasingly prevalent.89 The exclusionary impact may be relatively larger when rivals are small and not well funded. PAEs’ most frequent enforcement targets are small- and medium-sized firms. One survey found firms with under $10 million in annual revenue represented 55% of PAE defendants, and firms with under $100 million in annual revenue represented 66% of total patent defendants.90 And a common opinion is that PAEs “with weaker patents often target small companies that cannot afford the legal fees required to defend a patent infringement matter in court” and those companies may “opt to pay the demanded license fee rather than defend to avoid the expense of litigation that could dwarf the amount of the demanded license fee.”91 The concern with firms employing PAE vassals to target rivals may be exacerbated by the secrecy with which PAEs conduct their operations.

18

III. The Commission Should Conduct A Section 6(b) Study of PAEs That Includes A

Focus On Patent Transfers From Operating Companies

PAE activities are expanding and are impacting innovative industries. Thus PAEs, the evolving ways in which operating companies transfer patents to PAEs, and the myriad of ways those arrangements may harm competition, warrant investigation. 15 U.S.C. § 46(b), otherwise known as Section 6(b), provides an ideal tool for the Commission to examine PAE activities, and more specifically, the evolving and troubling practice of PAE “privateering.”

Section 6(b) enables the Commission to engage in a wide-ranging probe of business practices. Companies subject to orders issued under Section 6(b) can be compelled, among other things, to “file with the Commission” “special[] reports or answers in writing to specific questions, furnishing to the Commission such information as it may require as to the organization, business, conduct, practices, management, and relation to other[s].”92 In conducting a Section 6(b) investigation, the Commission is not limited to a “focused theory” of why the conduct might transgress the law,93 but rather may “satisfy [itself] that corporate behavior is consistent with the law and the public interest.”94

As the Commission’s Generic Drug Study and Authorized Generics Reports demonstrate, Section 6(b) provides the Commission flexible tools to investigate evolving practices and to assess their potential harms and benefits to competition, consumers and innovation.95 The Commission’s ability to evaluate and report facts about key activities that affect commerce is an important part of its mission, and the Commission’s use of its investigatory powers such as Section 6(b) has been important in the enactment of major legislation.96 Commission investigations have also provided important data that was considered in shaping the Security Act of 1933, the Public Utility Holding Company Act of 1935 and the Federal Power Act of 1935.97 PAE activities and patent transfers by operating companies to PAEs are similarly appropriate subjects for a Section 6(b) investigation for numerous reasons.

First, the conduct in question is rapidly growing and becoming more aggressive. The Commission’s 2011 IP Report sheds light on the significant potential harms threatened by PAEs and the many different types of business models PAEs employ. A model, by which operating companies outsource enforcement to PAEs, often retaining a stake in the proceeds, is emerging. A Section 6(b) study would enable the Commission to obtain information from PAEs and operating companies alike on the business rationale for those arrangements; the extent of those

19

arrangements; the prevalence of such arrangements; and the likely future direction of those arrangements. As one academic noted, conclusions about the effects of “privateering” are “difficult to draw with the information presently available and additional investigation seems warranted.”98 A Section 6(b) study, in other words, would enable the Commission to take a logical next step from the IP Report’s foundation and explore the ways in which PAEs, and their relationship with operating companies, are evolving.

Second, a Section 6(b) study of PAE activities focusing on operating company transfers is appropriate because the terms of most transfers between operating companies and PAEs and the extent to which operating companies have transferred patents to PAEs largely remains unknown. And, of course, operating companies’ concrete plans to initiate further transfers of patents to PAEs, and the motives for those transfers, remains unknown. A Section 6(b) inquiry would enable the Commission to determine – for particular industries – the scope of the practice; the likely trajectory of the practice; and other information important for making a judgment of the competitive consequences of operating company patent transfers to PAEs.

Third, a Section 6(b) inquiry is appropriate because how PAE activities, and specifically patent transfers from operating companies to PAEs, impact competition, consumers and innovation raise issues that require information from operating companies and PAEs, much of which is not publicly available. For example, it is a common belief that PAEs use the threat of litigation and holdup-driven damage awards to coerce settlements even where underlying infringement claims lack merit. Because settlements prior to litigation generate little, if any, public information, existing academic research methods have been inadequate in documenting these PAE activities.99 Data and other information from these stakeholders will shed light on the likely competitive consequences of the arrangement and enable the Commission to gather information from stakeholders with different perspectives on the practices at issue.

Fourth, Section 6(b) is an appropriate tool because the application of the antitrust laws to patent transfers to PAEs is unsettled. The precise circumstances in which such arrangements threaten anticompetitive effects are largely undeveloped in the case law. A Section 6(b) investigation accordingly is appropriate not only to enable the Commission to gather the requisite facts, but also to enable the Commission to form a judgment about the extent of the problem and, if a solution is needed, whether it lies in enforcement of the antitrust laws or in new legislation or regulation.

In short, obtaining information on the above-described subjects through a Section 6(b) inquiry will facilitate a richer understanding by the Commission of the impact of PAEs on

20

innovation and competition. The Commission will thereby be better situated to contribute to the dialogue on whether the solution to the many issues PAEs raise rests with legislative changes to the patent system, in influencing the shape of the patent laws through amicus efforts in the courts, or through enforcing the antitrust laws.

As for the precise shape of the Section 6(b) inquiry, we recommend that the Commission initially focus on the information technology industry. The IT industry has been a principal target of litigation by PAEs and has witnessed notable patent transfers from operating companies to PAEs. Moreover, many PAEs that have acquired patents in the IT industry are now contemplating acquiring patents in yet other areas. Thus, studying the role of PAE activities and patent outsourcing in the IT industry may provide a foundation for predicting the course of PAE activities elsewhere.

CONCLUSION

PAEs impose tremendous costs on innovative industries. These costs are exacerbated by the evolving practice of operating companies employing PAE privateers as competitive weapons. The consequences of this marriage on innovation are alarming. Operating company transfers to PAEs create incentives that undermine patent peace. Transfers to PAEs threaten royalty stacking, which can raise rivals’ costs and hinder competition in technology markets. The secrecy in which PAEs cloak their activities exacerbates all of these concerns and leaves the public without information needed to access the likely competitive effects of patent outsourcing practices. We therefore urge the antitrust agencies to study carefully the issue of operating company patent transfers to PAEs and recommend that a Commission inquiry under Section 6 is an appropriate vehicle for examining this issue of vital importance to the competitive health of this Country’s most important industries.

Dated: April 5, 2013

Respectfully submitted,

Google Inc.

[address]

BlackBerry [address]

EarthLink, Inc. [address]

Red Hat, Inc. [address]

____________

1 FEDERAL TRADE COMMISSION, THE EVOLVING IP MARKETPLACE: ALIGNING PATENT NOTICE AND REMEDIES WITH COMPETITION, 71 (Mar. 2011), (hereinafter “Evolving IP Marketplace” or “2011 IP Report”), available at http://www.ftc.gov/os/2011/03/110307patentreport.pdf.

2 U.S. CONST. ART 1, § 8, CL. 8.

3 2011 IP Report, supra note 1, at 2. “Poor patent notice also hinders competition by forcing firms to design

products with incomplete knowledge of the cost and availability of different technologies.” Id. at 3.

4 Id. at 3.

5Id. at 76.

6 Id. at 148.

7 Id. at 131.

8 Id. at 148.

9 For a discussion of patent “privateering,” See Tom Ewing, Indirect Exploitation of Intellectual Property Rights By

Corporations and Investors: IP Privateering and Modern Letters of Marque and Reprisal, 4 HASTINGS SCI. TECH. L. J. 1 (2012). See also Susan Decker, Patent Privateers Sail the Legal Waters against Apple, Google, Bloomberg (Jan. 11, 2013), http://www.bloomberg.com/news/2013-01-11/patent-privateers-sail-the-legal-waters-against-apple-google.html.

10 We believe the public would benefit from the details of the Commission’s finding, should the Commission elect to release a report.

11 Evolving IP Marketplace, supra note 1, at 52.

12 Id. at 53.

13 Id. at 71.

14 Christian Helmers & Luke McDonagh, Trolls at the High Court?, LSE Law, Society & Economy Working

Papers 13/2012 (2012), available at http://www.lse.ac.uk/collections/law/wps/WPS2012-13_Mcdonagh.pdf.

15 Alan Schoenbaum, President Obama Joins Innovators In Our Fight Against Patent Trolls, The Rackspace Blog (Feb. 20, 2013), http://www.rackspace.com/blog/president-obama-joins-innovators-in-our-fight-against-patent- trolls/.

16 Id.

17 Suzanne Michel, Let’s Defend Innovators Against Patent Trolls, Google Public Policy Blog (Feb. 27, 2013),

http://googlepublicpolicy.blogspot.com/2013/02/lets-defend-innovators-against-patent.html.

18 Jeff John Roberts, Obama Says Patent Trolls ‘Hijack’ and ‘Extort;’ So Do Something Mr. President, GigaOM (Feb. 16, 2013), http://gigaom.com/2013/02/16/obama-says-patent-trolls-hijack-and-extort-so-do-something-mr-president/.

19 RPX, Tracking PAE Activity: A Post-Script to the DOJ Review, http://www.rpxcorp.com/index.cfm?pageid=14&itemid=29 (Apr. 1, 2013).

20 James E. Bessen & Michael J. Meurer, The Direct Costs from NPE Disputes, at 31, Table 4, BOSTON UNIV. SCHOOL OF LAW, Law and Economics Research Paper No. 12-34 (June 28, 2012), available at http://ssrn.com/abstract=2091210.

21 RPX, Tracking PAE Activity: A Post-Script to the DOJ Review, supra note 19. In a study conducted by Lex Machina, “[o]f the 5 parties in the sample who filed the greatest number of lawsuits during the period studied, 4 were” PAEs; only one was an operating company. Sara Jeruss, Robin Feldman, & Joshua Walker, The American Invests Act 500: Effect of Monopolization Entities on U.S. Litigation, 11 DUKE L. & TECH. REV. 357, 361 (2012).

22 Id.; See also Patent Freedom, Litigations Over Time, https://www.patentfreedom.com/about-npes/litigations/ (last visited Apr. 1, 2013). The America Invents Act’s joinder rule may account for some of the increase in the number of suits filed in 2012 over 2011. See Tracie L. Bryant, The America Invents Act: Slaying Trolls, Limiting Joinder, 25 HARV. J.L. TECH. 673, 689-90 (2012).

23 Id. The significant decrease in the number of operating company defendants from 2011 to 2012 may reflect the impact of the America Invents Act, which increases the cost of suing multiple defendants by limiting the circumstances under which multiple defendants can be joined in the same suit. See Bryant, supra note 22, at 689-90.

24 Colleen V. Chien, Of Trolls, Davids, Goliaths, and Kings: Narratives and Evidence in the Litigation of High- Tech Patents, 87 N.C. L. REV. 1571, 1581 (2009), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1396319.

25 eBay, Inc. v. MercExchange, LLC, 547 U.S. 388 (2006).

26 Colleen V. Chien & Mark A. Lemley, Patents and the Public Interest, N.Y. TIMES (Dec. 13, 2011),

http://www.nytimes.com/2011/12/13/opinion/patents-smartphones-and-the-public-interest.html.

27 Colleen V. Chien & Mark A. Lemley, Patent Holdup, the ITC, and the Public Interest, CORNELL L. REV., Stanford Public Law Working Paper No. 2022168 at 116 (July 2, 2012), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2022168.

28 Id. at 115.

29 Chien & Lemley, Patents and the Public Interest, supra note 26.

30 See The International Trade Commission and Patent Disputes: Hearing Before the Subcomm. On Intellectual

Prop., Competition and the Internet of the H. Comm. On the Judiciary, 112 Cong. (2012) (statement of Colleen V. Chien, Santa Clara University Law School), available at http://judiciary.house.gov/hearings/Hearings%202012/hear_07182012.html.

31 Chien & Lemley, Patent Holdup, the ITC, and the Public Interest, supra note 27, at 115. As defined by professors Chien and Lemley, a non-practicing entity (“NPE”) includes PAEs as well as other firms such as individuals and universities. Id. at 110.

32 Id. at 140.

33 See , e.g., In re Certain Electronic Devices Including Handheld Wireless Communication Devices, Inv. Nos. 337-

TA-667, 337-TA-673 (combined) (2009) (finding domestic industry requirement met where PAE licensed an operating company, which engineered and produced articles covered by PAE’s U.S. patents); See also Wei Wang, Non-Practicing Complainants at the ITC: Domestic Industry or Not?, 27 BERKELEY TECH. L.J. 409, 435-63 (2012). Moreover, when a PAE relies on licensing activities to establish a domestic industry, licenSee s may not need to make a product covered by the patented invention. According to a recent ITC decision, “‘the [Section 337] statute does not require a complainant to manufacture the patented product nor does it require that a complainant show that a product covered by the . . . patent is made by the complainant’s licenSee .’” Ralph Mittelberger & Taniel Anderson, Non-Practicing Entities and the Backdoor to the ITC, at 6, 10-11, Support Paper for ABA Antitrust Section Spring Meeting (2011) (quoting Initial Determination (Public Version), at 10, In re Certain Digital Satellite Systems (DSS) Receivers & Components Thereof, Inv. No. 337-TA-392 (April 2001)), available at http://www.aipla.org/2011/spring/MATERIALS/Mittelberger_Paper.pdf.

34 James E. Bessen, et al., The Private and Social Costs of Patent Trolls, at 4, Working Paper, SSRN-id1957325 (September 19, 2011), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1930272.

35 James Bessen and Michael J. Meurer, The Direct Costs from NPE Disputes, Boston Univ. School of Law Working Paper No. 12-34 at 2 (June 22, 2012), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2091210.

36 Patent Trolls – A New Study and a Survey, Groklaw (July 13, 2012), http://www.groklaw.net/articlebasic.php?story=20120712151437524.

37 Bessen, et al., supra note 34, at 4.

38 Letter from William Barber, President American Intellectual Property Law Association to Hon. Victoria Espinel,

United States Intellectual Property Enforcement Coordinator, OMB, Executive Office of the President, at 3 (Aug. 10, 2012), available at http://www.aipla.org/advocacy/executive/Documents/AIPLA%20Comments%20to%20IPEC%20on%20Joint%20St rategic%20Plan%20on%20IP%20Enforcement%20-%208.10.12.pdf.

39 James Bessen and Michael J. Meurer, The Direct Costs from NPE Disputes, supra note 35, at 12-13.

40 See Colleen V. Chien, Startups and Patent Trolls, Working Paper, at 10-14 (Sep. 28, 2012) (discussing impact of

PAE demands on entrepreneurial firms’ operations), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2146251.

41 PAEs rarely prevail on the merits of infringement. See John R. Allison, Mark A. Lemley & Joshua Walker, Patent Quality and Settlement Among Repeat Patent Litigants, 99 GEO. L.J. 677, 706 (2011) (PAE win rate in cases decided on the merits is just 8%, versus 40% for other entities).

42 Bessen & Meurer, supra note 35, at 17.

43 Id. at 30.

44 Brian Yeh, An Overview of the ‘Patent Trolls’ Debate, Congressional Research Service Report for Congress, at

13 (Aug. 20, 2012), available at https://www.eff.org/sites/default/files/R42668_0.pdf.

45 A large share of the costs PAEs impose on innovation are not incurred in litigation, but settlements obtained under threat of litigation. Therefore, studies that attempt to measure economic harm from PAEs by examining litigation outcomes almost certainly and substantially understate the economic harm they cause.

46 Catherine Dunn, Putting a Price Tag on ‘Patent Troll’ Litigation, Law.com (July 11, 2012), http://www.law.com/corporatecounsel/PubArticleCC.jsp?id=1202562484895&Putting_a_Price_Tag_on_Patent_Tro ll_Litigation&slreturn=20121028183631 (quoting Bessen & Meurer).

47 Yeh, supra note 44, at 2; See also James Bessen & Michael Meurer, Patent Trolls in Public, Patently-O (Mar. 19, 2013), http://www.patentlyo.com/patent/2013/03/patent-trolls-in-public.html (estimating that only 26% of licensing revenues “flows to inventors of all types”).

48 Id. at 8 (emphasis in original).

49 Id. (citing Michael Risch, Patent Troll Myths, 42 SETON HALL L. REV. 457, 459-61 (2012)).

50 See , e.g., Timothy Simcoe, Patent Assertion Entities[:] Potential Efficiencies (Dec. 10, 2012),

http://www.justice.gov/atr/public/workshops/pae/presentations/290072.pdf.

51 Evolving IP Marketplace, supra note 1, at 71.

52 Id. (claiming that PAEs’ acquisition and assertion of patents against existing products “can distort competition in technology markets, raise prices and decrease incentives to innovate”).

53 See , e.g., Tim Frain, Nokia Response to Patent Standards Workshop, Project No., P11-1204, at 5 (July 8, 2011), (“From a policy and regulator’s perspective, the role and impact of NPEs on legitimate enterprise perhaps deserves more careful attention.”), available at http://www.ftc.gov/os/comments/patentstandardsworkshop/00032-60891.pdf; Horacio Gutierrez, The SHIELD Act: Another Step in the Patent Reform Discussion, Technet (Feb. 27, 2013), http://blogs.technet.com/b/microsoft_on_the_issues/archive/2013/02/27/the-shield-act-another-step-in-the-patent- reform-discussion.aspx (“Microsoft is harassed by PAEs as much as anyone in our industry: at any given moment, we face as many as 60 PAE suits, comprising the vast majority of patent cases brought against us.”).

54 See generally Tom Ewing & Robin Feldman, The Giants Among Us, 2012 STAN. TECH. L. REV. 1, at ¶¶ 4-5 (2012) (describing how operating companies funded PAEs and how “mass aggregators purchase large chunks, even the majority, of an operating company’s patents and patent applications”), available at http://stlr.stanford.edu/pdf/feldman-giants-among-us.pdf.

55 Another harm not discussed at length here includes how certain PAEs’ accretion of massive patent portfolios might anticompetitively shield weak patents.

56 See Shapiro, Navigating the Patent Thicket: Cross Licenses, Patent Pools, and Standard Setting, 1 INNOVATION POLICY AND THE ECONOMY 119, 127, 129-30 (2001) (“[C]ross licenses can solve the complements problem, at least among two firms, and thus be highly procompetitive”), available at http://faculty.haas.berkeley.edu/shapiro/thicket.pdf.

57 U.S. DEP’T OF JUSTICE & FEDERAL TRADE COMMISSION, ANTITRUST GUIDELINES FOR LICENSING OF INTELLECTUAL PROPERTY 28 (1995), available at http://www.justice.gov/atr/public/guidelines/0558.pdf.

58 See Evolving IP Marketplace, supra note 1, at 9 (“An important goal in aligning the patent system and competition policy is to facilitate ex ante transactions while making ex post transactions less necessary or frequent.”).

59 See generally Ewing & Feldman, supra note 54, ¶¶ 102-115 (describing how “Just-In-Time” patenting can counter patent suits).

60 Id. ¶ 115. Certain patent acquisitions by operating companies may enhance or foster patent peace. For example, when a company subject to patent litigation purchases a patent it can assert in a patent countersuit, the outcome may be a cross-license or similar settlement. At times, PAEs have served as a source of such patent rights. Ewing & Feldman, supra note 54, ¶¶ 49-50. And purchasing patents from PAEs for inclusion in a defensive patent portfolio can reduce licensing costs for an entire industry.

61 It is not uncommon for “patents initially acquired defensively” to “end[] up in the hands of PAEs – arguably increasing, rather than reducing, patent risk.” Colleen Chien, A Race to the Bottom, IAM MAGAZINE, Jan.- Feb. 2012, at 10, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1978882.

62 See , e.g., Ilene Knable Gotts & Scott Sher, The Particular Antitrust Concerns with Patent Acquisitions, COMP. LAW. INT’L, Aug. 2012, at 32 (noting that a “troll may have a stronger incentive to extract monopoly rents from infringers because it is not susceptible to counterclaims for infringement”), available at http://www.wsgr.com/publications/PDFSearch/sher-august-12.pdf.

63 As put by a PAE advocate: “NPEs don’t have anything to lose when enforcing their rights. When you are sued,

you have to allocate resources to defend your rights, which takes money away from your core processes. NPEs’

resources and business models are designed to enforce patents. You need to understand what NPEs are doing

because they change the landscape of IP, and you need to develop an R&D strategy to navigate it and determine

where you fit in.” Michael G. Craig, How Nonpracticing Entities and Patent Trolls Are Changing the IP Landscape,

Smart Business (Oct. 1, 2012), http://www.sbnonline.com/2012/10/how-nonpracticing-entities-and-patent-trolls-are-

changing-the-ip-landscape-brouse/.

64 This is especially true when Firm A has a very large patent portfolio: the marginal value of a few hundred patents, when part of a portfolio of many thousands, may be quite small in securing cross-licenses or patent peace with Firm B. But when transferred to a PAE, those once marginal patents could potentially generate significant returns.

65 See Colleen Chien, the Who Owns What Problem in Patent Law, at 5-6, Working Paper No. 03-12 (Jan. 2012) (discussing PAE techniques to obfuscate patent ownership), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1995664. PAEs often acquire and maintain their patents in secret. Id. at 3-4 (discussing a survey of 915 patent litigations where in “a third of the cases, the plaintiff was not the patent owner of record as of the day the litigation was initiated.”).

66 See Rambus Inc. v. FTC, 522 F.3d 4576 (D.C. Cir. 2008); In the Matter of Union Oil Co. of California, No. 9305, FTC, Commission Opinion, at 6 (Aug. 2, 2005), http://www.ftc.gov/os/adjpro/d9305/050802statement.pdf

67 See Negotiated Data Solutions LLC, FTC Docket No. C-4234, 2008 WL 2583308 (Jan. 22, 2008) (entering consent order binding patent holder to its predecessor in interest’s commitment to SSO); See also In re Negotiated Data Solutions LLC, No. 0510094, Statement of the FTC, http://www.ftc.gov/os/caselist/0510094/080122statement.pdf.

68 Evolving IP Marketplace, supra note 1, at 71.

69 Mike Mansick, Vast Majority of Software Patents in Lawsuits Lose, TechDirt (Sep. 24, 2010),

http://www.techdirt.com/articles/20100924/02132911143/vast-majority-of-software-patents-in-lawsuits-lose.shtml; John Allison, Mark Lemley & Joshua Walker, Patent Quality and Settlement Among Repeat Patent Litigants, Stanford Law and Economics Olin Working Paper No. 398 (Sep. 30, 2012), available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1677785.

70 Mansick, supra note 69.

71 Carl Shapiro, Injunctions, Hold-Up, and Patent Royalties, 12 AM. L. & ECON. REV. 281, 398 (2010), available at

http://faculty.haas.berkeley.edu/shapiro/royalties.pdf.

72 See Rafe Blandford, Google Files Antitrust Complaint against Nokia and Microsoft, All About Symbian, June 1, 2012, http://www.allaboutsymbian.com/flow/item/14946_Google_files_EU_antitrust_comp.php (quoting Nokia statement that “any commitments made for standards essential patents transfer to the acquirer and existing licenses for the patents continue”).

73 See Evolving IP Marketplace, supra note 1, at 71.

74Brian J. Love, Patentee Overcompensation and the Entire Market Value Rule, 60 STAN. L. REV. 263, 280 (2007) (showing that where a product infringes patents held by multiple entities, “the infringer faces the prospect of paying overlapping royalties”).